Did you know that dark pools are like the speakeasies of the stock market—hidden away from the public and filled with mystery? In this article, we dive into the intriguing world of dark pool trading, exploring its suitability for beginners. We’ll clarify what dark pools are, how they differ from regular exchanges, and assess their safety and risks for novice traders. Additionally, we’ll discuss the potential for profit, necessary skills, and the impact of liquidity on trading. Finally, we’ll examine whether dark pools are a good fit for small investors and how they affect market transparency. Join us as we unravel the complexities of dark pool trading with insights from DayTradingBusiness!

Is Dark Pool Trading Safe for Beginners?

Dark pool trading isn't safe for beginners because it lacks transparency and can be risky due to limited oversight. It’s designed for institutional investors, not new traders, and can lead to unexpected price movements or limited liquidity. If you're new, stick to public exchanges where transparency and regulation protect you.

What Are Dark Pools in Stock Trading?

Dark pools are private stock trading venues where large investors buy and sell shares without revealing their orders to the public. They help institutions avoid market impact and get better prices for big trades. For beginners, dark pool trading isn't suitable because it lacks transparency, making it hard to understand market movements and increasing risk. It's designed for professional traders and institutions with advanced strategies.

How Do Dark Pools Differ from Regular Exchanges?

Dark pools are private trading venues where large orders are executed without public visibility, unlike regular exchanges that display order books openly. They let institutional investors trade big blocks quietly, avoiding market impact. Regular exchanges show every bid and ask, providing transparency and price discovery. Dark pools lack real-time public data, making them less suitable for beginners who need clear price signals. They’re designed for experienced traders and institutions, not for those just starting out.

Can Beginners Profit from Dark Pool Trading?

Beginners should avoid dark pool trading because it’s complex, less transparent, and risky. It requires advanced knowledge of market mechanics and access to sophisticated tools. Most beginners lack the experience to navigate hidden order flows and execute timely trades in dark pools. It’s better to build a solid foundation with traditional markets before considering dark pool trading.

What Risks Are Associated with Dark Pool Trading?

Dark pool trading carries risks like lack of transparency, making it hard to gauge market impact. Price manipulation or false signals can occur due to limited visibility. Large orders may cause sudden, unpredictable price swings. Less regulation means higher chances of fraud or unfair practices. For beginners, these risks increase the chance of unexpected losses and misinformed decisions.

Is Dark Pool Trading Regulated?

Dark pool trading is regulated, but less transparently than public exchanges. It operates under securities laws and oversight by agencies like the SEC, but since transactions happen off public order books, oversight is limited. This reduced transparency makes dark pools riskier for beginners.

How Do I Start Trading in Dark Pools?

Dark pool trading isn’t ideal for beginners because it’s complex and lacks transparency. If you’re new, start with regular exchanges to learn market fundamentals first. Understand how dark pools work, their risks, and the potential for less liquidity and price impact. Only consider dark pool trading after gaining experience and consulting with a financial advisor.

What Skills Are Needed for Dark Pool Trading?

Dark pool trading requires understanding of market microstructure, order types, and liquidity dynamics. You need strong analytical skills to interpret hidden order flows and price movements. Knowledge of trading algorithms and technology platforms used in dark pools is essential. Risk management skills are crucial, since dark pools can be less transparent and more volatile. Experience with advanced trading strategies and regulatory rules also helps. Overall, dark pool trading isn’t suitable for beginners due to its complexity and need for specialized skills.

Are Dark Pools Suitable for Small Investors?

Dark pool trading isn’t suitable for small investors or beginners. It’s designed for institutional traders and large investors who can handle the complexity and risks involved. Small investors lack the resources and market insight to navigate dark pools effectively.

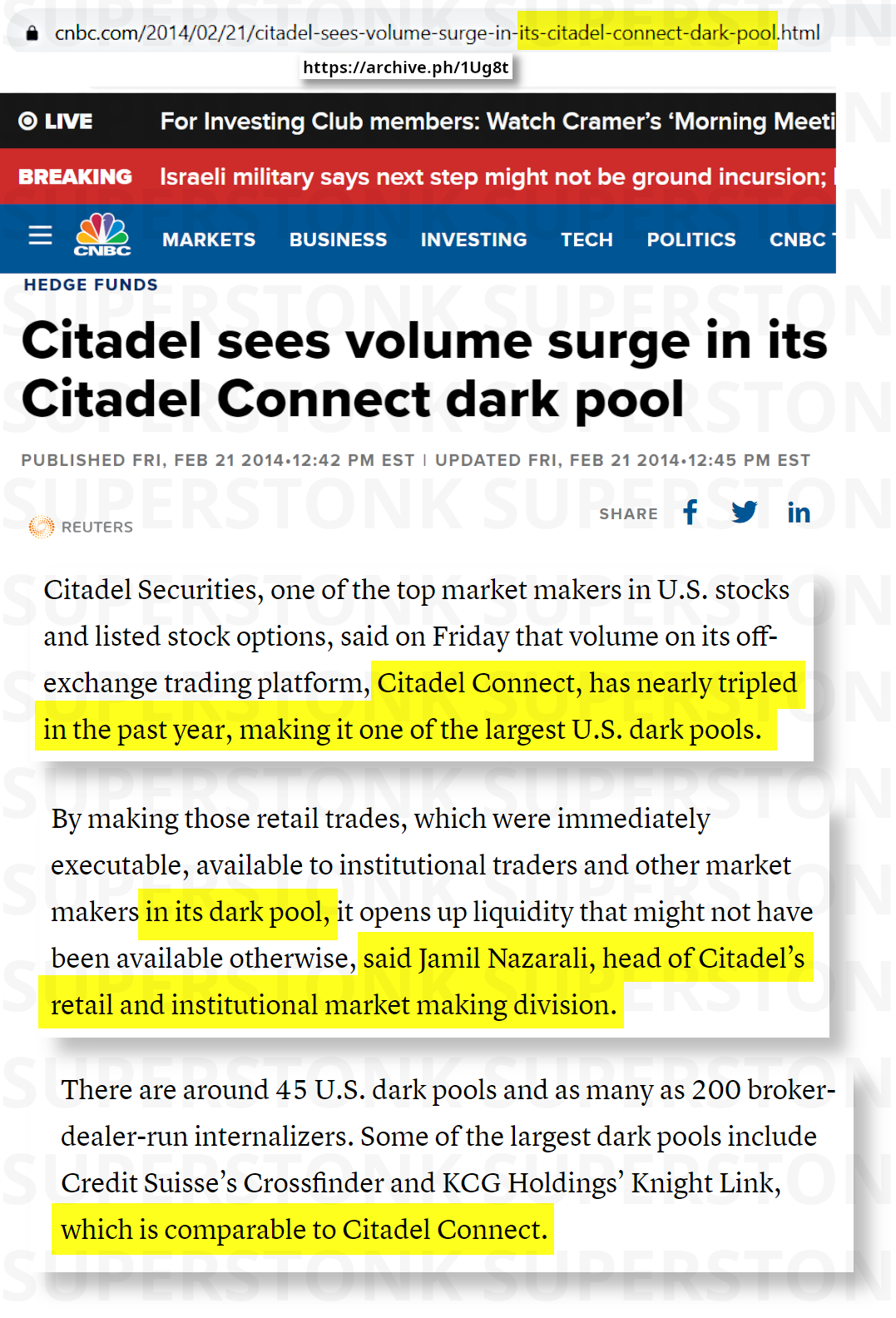

How Does Liquidity in Dark Pools Affect Trading?

Liquidity in dark pools means large trades can happen without moving the market, reducing price impact. This makes them attractive for big investors wanting to hide their moves and get better prices. For beginners, this hidden liquidity can be confusing and risky, since they can't see the full order book or market depth. It may lead to less transparency, making it harder to understand true market conditions. Overall, dark pool liquidity benefits experienced traders but can be risky for newcomers due to limited visibility and potential for hidden risks.

Learn about How Do Dark Pools Affect Day Trading?

What Are the Benefits of Dark Pool Trading?

Dark pool trading offers benefits like reduced market impact, better order execution, and less price manipulation, making large trades less obvious. It provides anonymity, helping investors avoid front-running and market volatility. However, it's complex and less transparent, which can be risky for beginners.

How Do Dark Pools Impact Market Transparency?

Dark pool trading reduces market transparency because it hides large orders from the public, making it harder for retail investors to see true market activity. This lack of visibility can lead to less informed decisions and potential price manipulation. For beginners, dark pools pose risks due to limited transparency, making them less suitable for inexperienced traders.

Learn about How Do Dark Pools Impact Market Fairness?

Can Dark Pool Trading Help Avoid Market Impact?

Dark pool trading can help avoid market impact by allowing large orders to execute privately without moving the price. It provides a discreet environment where big trades don't trigger immediate market reactions. However, for beginners, understanding the risks and mechanics of dark pools is complex. It's not typically suitable for those new to trading, as it requires advanced knowledge and experience.

What Are the Costs of Trading in Dark Pools?

Dark pool trading typically involves lower fees than public exchanges, but costs can include transaction fees, data fees, and sometimes higher spreads. Institutional traders may pay a small fee per trade, while some dark pools charge a percentage of the trade value. For beginners, the costs are less transparent and can be higher if they don’t understand how liquidity and spreads work in dark pools.

Is Dark Pool Trading Better for Institutional or Retail Traders?

Dark pool trading is better suited for institutional traders because it offers large order execution without impacting the market, which retail traders typically can't access or need. For beginners, dark pools are not suitable due to their complexity, lack of transparency, and higher risk.

Conclusion about Is Dark Pool Trading Suitable for Beginners?

In conclusion, while dark pool trading offers unique advantages such as reduced market impact and enhanced privacy, it poses significant risks that may not be suitable for beginners. Understanding the intricacies of dark pools, including their regulations, costs, and liquidity dynamics, is crucial for any trader. As you navigate this complex landscape, leveraging resources and expertise from DayTradingBusiness can provide valuable insights to help you make informed decisions and enhance your trading skills.