Did you know that traders often joke that the only thing more unpredictable than their morning coffee is market price movement? In the realm of microstructure analysis, understanding price movement is essential for grasping market dynamics. This article delves into the significance of price movement, highlighting its crucial role in market liquidity, bid-ask spreads, and order flow. We’ll explore how small price fluctuations can impact traders, the relationship between volatility and market efficiency, and the implications of transaction costs. Moreover, we'll discuss how price jumps, patterns, and trends can reveal market manipulation and inform high-frequency trading strategies. For those navigating the complexities of trading, insights from DayTradingBusiness provide a valuable roadmap to mastering price movement.

Why is price movement important in microstructure analysis?

Price movement reveals how supply and demand interact at the micro level, showing liquidity, order flow, and trader behavior. It helps identify short-term trends, market efficiency, and potential price manipulation. Analyzing price changes uncovers how different market participants influence the market, enabling better prediction of future movements.

How does price movement reflect market liquidity?

Price movement indicates market liquidity because tight, stable prices show high liquidity with many buyers and sellers, while sharp swings suggest low liquidity and fewer participants. When prices move smoothly, it means there's enough trading volume to absorb large orders without big shifts. Sudden jumps or drops reveal limited liquidity, making the market more vulnerable to volatility. In microstructure analysis, observing how prices change helps identify how easily assets can be bought or sold without impacting the price significantly.

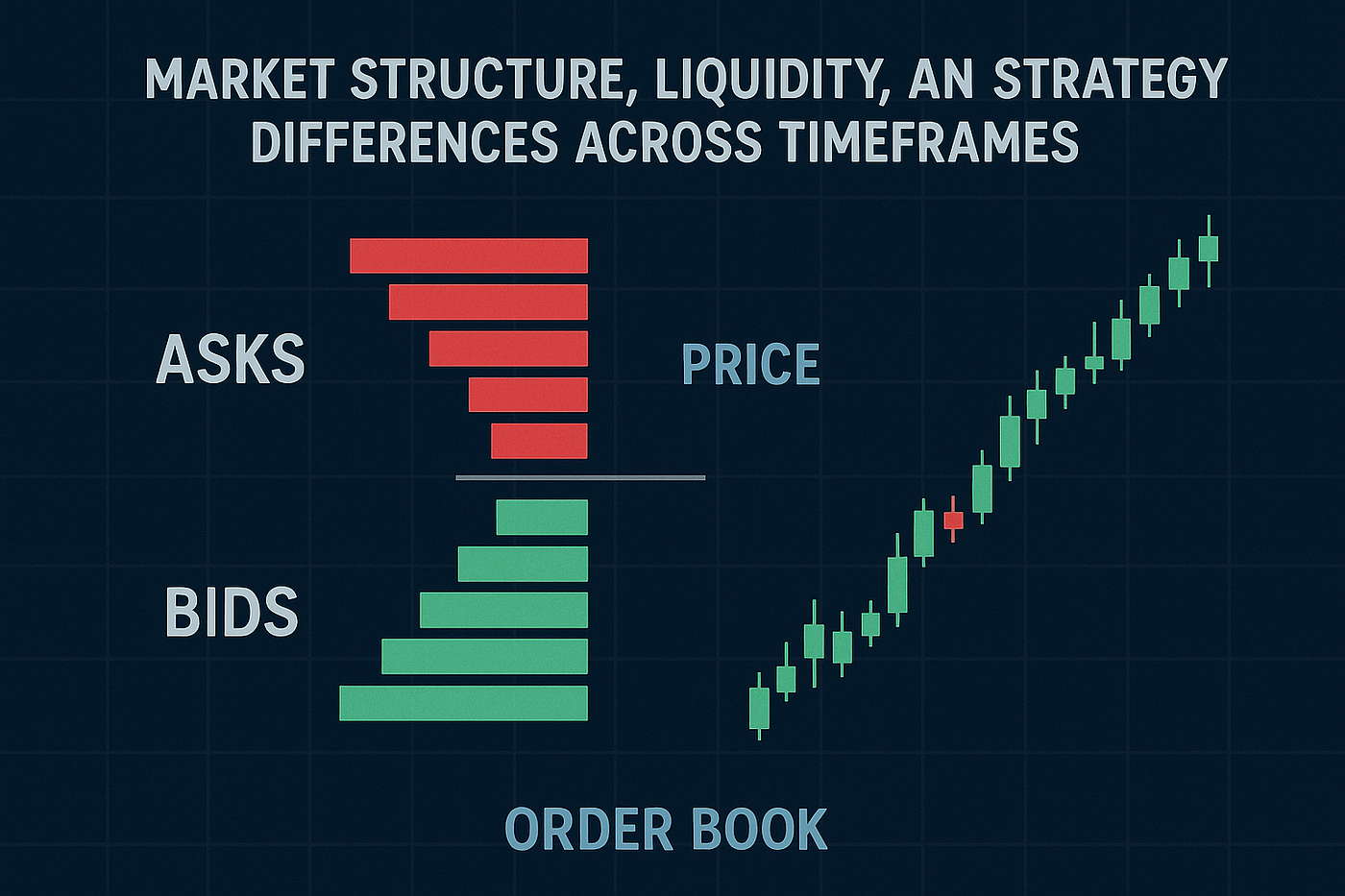

What role does bid-ask spread play in price changes?

The bid-ask spread influences price changes by reflecting market liquidity and trading costs. A wider spread often signals lower liquidity, causing larger price jumps when trades occur. When traders buy at the ask and sell at the bid, the spread acts as a buffer, but narrow spreads facilitate quicker, smaller price movements. Changes in the spread can indicate shifting supply and demand, directly impacting short-term price volatility in microstructure analysis.

How do order flow and price movement relate?

Order flow drives price movement; when large buy orders hit the market, prices jump. Conversely, a surge in sell orders pushes prices down. Microstructure analysis shows that tracking order flow reveals why prices change—it's the real-time buying and selling that causes movement. Price movement reflects the imbalance between supply and demand created by order flow.

Why do small price movements matter for traders?

Small price movements reveal market liquidity, order flow, and trader behavior, helping traders predict short-term trends. They indicate supply and demand shifts, allowing quick entry or exit decisions. In microstructure analysis, tiny price changes highlight market efficiency and potential reversals. Recognizing these movements helps traders manage risk and optimize timing in fast-paced environments.

How can price volatility indicate market efficiency?

Price volatility shows how quickly prices change, reflecting how efficiently markets process new information. High volatility suggests rapid adjustment, meaning prices incorporate info swiftly—indicating market efficiency. Conversely, low volatility may signal slow info dissemination or market inefficiencies. Sudden price swings often reveal active trading and transparent price discovery, key to efficient markets. Stable prices can point to less info flow or liquidity issues, hinting at inefficiencies. In microstructure analysis, tracking price movement helps assess whether markets react promptly and accurately to news, revealing their overall efficiency.

What is the connection between price impact and trading volume?

Higher trading volume usually amplifies price impact because more trades influence the market price. When volume spikes, even small orders can cause noticeable price movements, reflecting increased liquidity and market activity. Conversely, low volume dampens price impact, making prices less responsive to trades. In microstructure analysis, understanding this link helps explain how liquidity and trade size drive price changes.

Why do price jumps matter in market microstructure?

Price jumps reveal liquidity gaps and market shocks, affecting trading strategies and risk management. They indicate how quickly prices can change due to order flow or information, impacting market efficiency. Sudden moves can signal underlying market stress or informational asymmetries, influencing trader behavior and market stability.

How does price movement affect price discovery?

Price movement reveals how quickly and accurately markets incorporate new information, guiding effective price discovery. Rapid, responsive price changes indicate that traders are quickly adjusting to news, improving market efficiency. Conversely, sluggish or erratic price moves can signal poor information flow or market inefficiencies, hindering accurate price discovery. Persistent price shifts help traders identify fair value, while sudden jumps may reflect reactions to new data or liquidity shocks. Overall, price movement acts as a real-time indicator of how well the market is uncovering true asset value.

Why is understanding price patterns crucial for high-frequency traders?

Understanding price patterns is crucial for high-frequency traders because it helps them predict short-term moves, identify liquidity shifts, and optimize trade timing. Recognizing these microstructure patterns lets traders exploit tiny price discrepancies before others notice, boosting profitability. Without grasping price movement nuances, they risk missing quick opportunities or making costly mistakes in volatile markets.

How do transaction costs influence price movement?

Transaction costs slow down price movement because they create a barrier to trading, making traders hesitant to act on small price changes. Higher transaction costs reduce trading frequency, smoothing out price fluctuations. When costs are low, traders react quickly, causing more rapid and volatile price movements. In microstructure analysis, understanding these costs explains why prices move smoothly or jump sharply, reflecting traders' willingness to buy or sell.

What does price movement reveal about market depth?

Price movement reveals how much buy and sell orders are stacked at different levels, indicating market depth. Large, rapid price swings suggest shallow depth with few orders to absorb trades, while stable prices show deep markets with ample liquidity. Sharp movements signal limited liquidity and potential for volatility, whereas gradual shifts point to strong market depth and a resilient order book.

How does order book imbalance impact price changes?

Order book imbalance signals buying or selling pressure, causing quick price moves. When buy orders outweigh sell orders, prices tend to rise; more sell orders push prices down. Imbalance shows supply and demand shifts, prompting traders to react and drive prices in the direction of the imbalance. It’s a key indicator for short-term price changes in microstructure analysis.

Why should investors monitor price trends in microstructure?

Investors monitor price trends in microstructure because they reveal short-term market dynamics, liquidity, and order flow. Tracking these movements helps identify trading opportunities, potential reversals, and market sentiment. Understanding microstructure price trends allows investors to optimize entry and exit points, reduce transaction costs, and manage risk more effectively.

How does price movement help identify market manipulation?

Price movement reveals abnormal patterns like sudden spikes or dips that don’t match normal market behavior. Sharp, unexplained jumps or drops often signal manipulation such as pump-and-dump schemes. Consistent, irregular price swings around low liquidity or large trades can indicate wash trading or spoofing. Analyzing these movements helps detect when traders are artificially influencing prices to deceive others.

Conclusion about Why Does Price Movement Matter in Microstructure Analysis?

In summary, understanding price movement is crucial for effective microstructure analysis, as it directly influences market liquidity, trading strategies, and price discovery. Key factors such as bid-ask spreads, order flow, and transaction costs play significant roles in shaping price dynamics. For traders, especially high-frequency ones, monitoring small price movements and volatility can provide insights into market efficiency and potential manipulation. By honing in on these elements, investors can make more informed decisions in the complex world of trading. For comprehensive insights and support, DayTradingBusiness is your trusted resource.