Did you know that a day trader can lose their shirt faster than you can say "market volatility"? In the fast-paced world of day trading, compliance plays a critical role in ensuring that trading platforms operate safely and fairly. This article delves into the essence of compliance in day trading platforms, highlighting its importance in certification, security, and user trust. We’ll explore key regulations, compliance requirements, and the penalties for non-compliance, all while emphasizing how traders can identify trustworthy platforms. With insights from DayTradingBusiness, this guide is essential for anyone looking to navigate the trading landscape confidently.

What is compliance in day trading platforms?

Compliance in day trading platforms ensures they follow financial regulations, protect customer funds, and maintain transparency. It involves adherence to rules set by authorities like the SEC or FINRA, including anti-money laundering (AML) and know-your-customer (KYC) policies. Certification requires platforms to prove they meet these standards, safeguarding traders from fraud and operational risks. Without compliance, platforms risk legal penalties, loss of trust, and potential shutdowns.

Why is compliance important for trading platform certification?

Compliance ensures trading platforms meet legal, security, and fairness standards, protecting investors and maintaining market integrity. It verifies the platform's adherence to regulations, reducing fraud and operational risks. Certification through compliance builds trust with users, showing the platform is reliable and transparent. Without compliance, platforms risk penalties, reputational damage, and potential shutdowns. It’s essential for regulatory approval and long-term success in day trading.

How does compliance affect the security of a trading platform?

Compliance ensures trading platforms follow regulations that enforce strong security standards, protecting user data and funds. It mandates regular security audits, data encryption, and secure transaction protocols, reducing vulnerabilities. When a platform meets compliance, it builds trust, making it less attractive to hackers and fraudsters. Overall, compliance acts as a framework that strengthens security measures, preventing breaches and ensuring safe day trading environments.

What regulations do day trading platforms need to follow?

Day trading platforms must comply with financial regulations like SEC and FINRA rules, anti-money laundering laws, and data security standards such as GDPR or CCPA. They need to implement strong KYC procedures, ensure transparent order execution, and maintain accurate trade records. Regulatory compliance also requires regular audits, cybersecurity measures, and disclosures about risks. Certification involves proving adherence to these standards to protect investors and maintain market integrity.

How does compliance ensure fair trading practices?

Compliance enforces rules that prevent manipulation, fraud, and unfair practices on trading platforms. It ensures platforms follow regulations that promote transparency, fair order execution, and equal access for all traders. By adhering to these standards, compliance helps create a level playing field, reducing unfair advantages and protecting traders from deceptive practices.

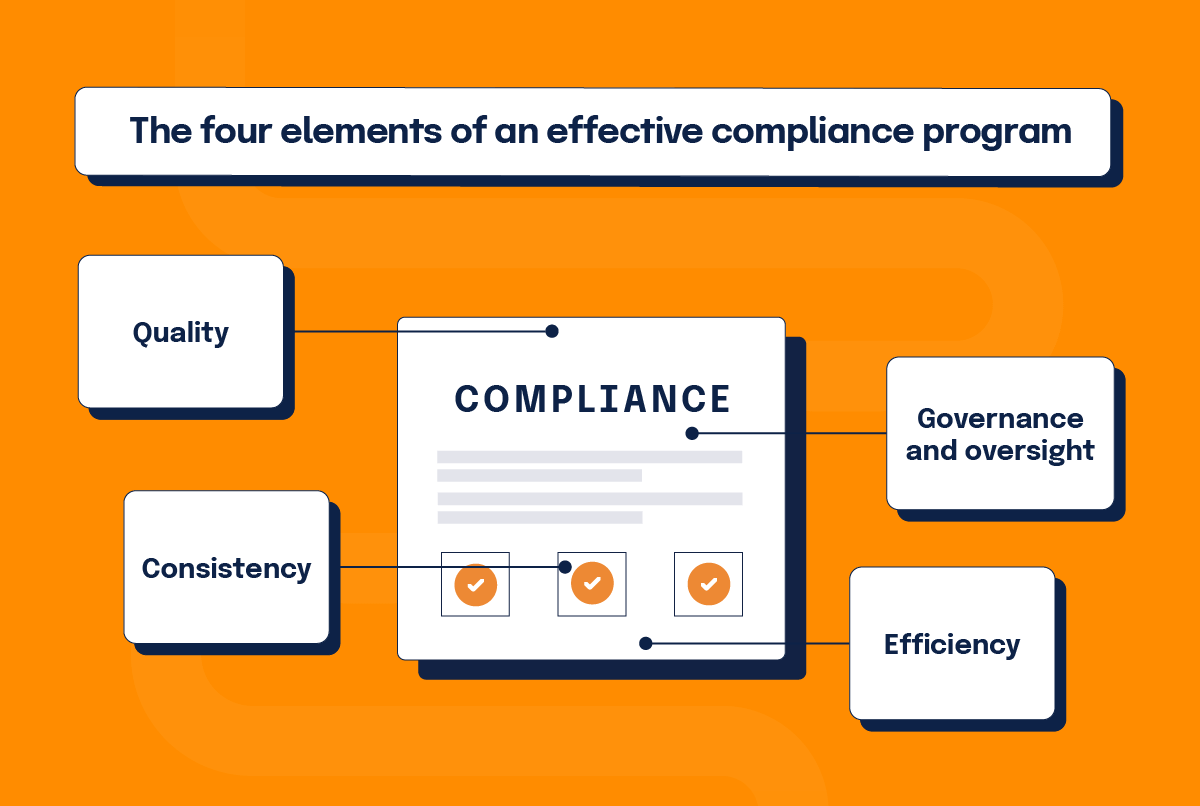

What are the key compliance requirements for platform certification?

Key compliance requirements for platform certification include adhering to financial regulations like anti-money laundering (AML), know your customer (KYC) procedures, data security standards such as GDPR or CCPA, transparent fee disclosures, and ensuring fair trading practices. Platforms must also implement robust risk management systems, maintain accurate audit trails, and comply with industry-specific licensing rules. These standards protect users and ensure the platform operates legally and ethically.

How do regulators verify compliance in trading platforms?

Regulators verify compliance in trading platforms through audits, reviewing security protocols, checking adherence to trading rules, and monitoring data handling. They test platform integrity, verify transparency in order execution, and ensure anti-money laundering measures are in place. Regular inspections and reporting requirements help regulators confirm platforms meet legal standards and protect traders.

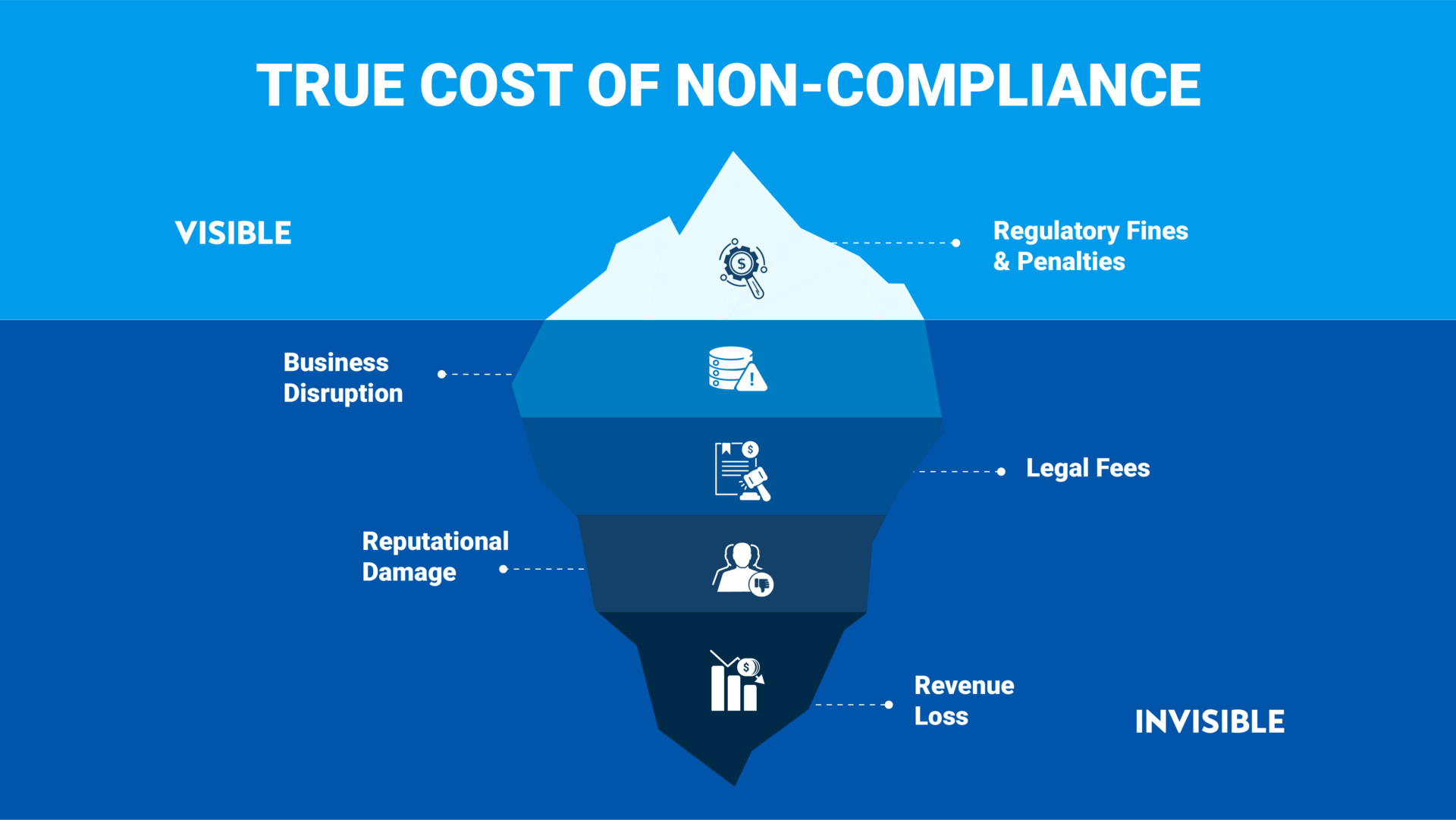

What penalties exist for non-compliance in trading platforms?

Penalties for non-compliance include fines, suspension or revocation of platform licenses, legal action, and bans for traders. Non-compliance risks damage to reputation and loss of trading privileges. Regulatory bodies like the SEC or FCA enforce these penalties to ensure safety and fairness in trading platforms.

How does compliance impact user trust and platform credibility?

Compliance builds user trust by showing the platform follows legal standards and protects user funds. It boosts credibility, making traders confident in the platform’s legitimacy. When a platform is certified and adheres to regulations, users see it as reliable and safe, encouraging more active trading and long-term loyalty. Non-compliance, on the other hand, raises doubts and risks, damaging trust and reputation.

What role does compliance play in preventing fraud and manipulation?

Compliance ensures that day trading platforms follow legal standards and industry regulations, reducing opportunities for fraud and manipulation. It enforces transparency, proper reporting, and secure trading practices, which protect traders from deceptive schemes. By adhering to compliance, platforms establish trust, discourage manipulative behaviors like pump-and-dump schemes, and create a fair trading environment. Overall, compliance acts as a safeguard, detecting and preventing fraudulent activities before they harm traders or the market.

How can traders identify compliant trading platforms?

Traders identify compliant trading platforms by checking for proper regulation from authorities like the SEC, FCA, or ASIC. Look for license numbers and verify them on official regulatory websites. Ensure the platform follows strict security protocols, offers transparent fee structures, and adheres to anti-money laundering standards. User reviews and industry certifications also indicate compliance. Avoid platforms without clear licensing or regulatory oversight.

What are the common compliance standards for day trading platforms?

Common compliance standards for day trading platforms include FINRA and SEC regulations, Anti-Money Laundering (AML) policies, Know Your Customer (KYC) procedures, and data security protocols like GDPR or CCPA. These standards ensure platforms operate transparently, protect user data, prevent fraud, and adhere to financial laws. Compliance certification confirms the platform's trustworthiness and legal standing, safeguarding traders and maintaining market integrity.

Learn about How do broker compliance standards influence day trading practices?

How often do trading platforms need to update their compliance measures?

Trading platforms should update their compliance measures at least quarterly to stay ahead of regulations and industry standards. However, major regulatory changes may require immediate updates. Ongoing monitoring and annual reviews are essential to maintain certification and ensure legal operation.

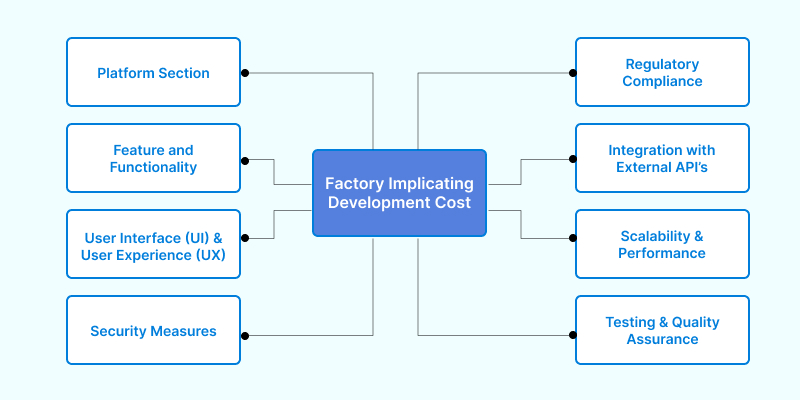

How does compliance influence platform features and functionality?

Compliance determines platform features and functionality by enforcing rules that ensure security, transparency, and fairness. Certified platforms must include features like secure login, real-time data, order verification, and audit trails to meet regulatory standards. Non-compliance risks legal issues, limiting access to essential trading tools and risking user trust. Compliance also drives the integration of features like risk management tools and reporting functions, shaping how the platform operates and protects traders.

What certifications indicate a compliant trading platform?

Certifications like FINRA, SEC registration, and FCA approval show a trading platform complies with regulations. These licenses verify the platform follows strict rules for security, transparency, and investor protection. Look for platforms with relevant industry certifications such as ISO 27001 for security or PCI DSS for payment processing. Compliance certifications ensure the platform adheres to legal standards, reducing fraud risk and providing a safer trading environment.

Conclusion about What Role Does Compliance Play in Day Trading Platform Certification?

In conclusion, compliance is a fundamental aspect of day trading platform certification that ensures security, fairness, and user trust. Adhering to regulatory standards not only protects traders from fraud and manipulation but also enhances the credibility of the platform. For traders seeking reliable platforms, understanding compliance requirements is crucial, as it directly influences their trading experience. Staying informed about these standards can help traders make educated choices and foster a safer trading environment. For more insights on navigating compliance in day trading, explore the resources available through DayTradingBusiness.

Learn about What role does leverage play in day trading success?