Did you know that day trading brokers have more compliance obligations than a cat has lives? In the fast-paced world of day trading, brokers play a pivotal role, not just in executing trades but also in adhering to a myriad of compliance laws. This article delves into the essential responsibilities of day trading brokers, covering their legal obligations, licensing requirements, and the measures they take to protect customer funds. We’ll also explore how compliance laws shape their operations, the need for rigorous reporting and record-keeping, and the critical role they play in preventing fraud and money laundering. Additionally, we will discuss the necessary disclosures and ethical standards brokers must uphold to maintain client trust. With insights from DayTradingBusiness, you’ll gain a comprehensive understanding of how brokers navigate the complex regulatory landscape to ensure a safe trading environment.

What are the main legal responsibilities of day trading brokers?

Day trading brokers must ensure customer accounts comply with regulations like SEC and FINRA rules. They are responsible for verifying client identities (KYC), monitoring for suspicious activity, and preventing money laundering. Brokers must provide transparent disclosures about risks, trading fees, and margin requirements. They’re also required to supervise trading activity, report suspicious transactions, and maintain accurate records. Ensuring clients understand margin rules and enforcing trading limits are key responsibilities. Overall, brokers must uphold fair, transparent, and compliant trading environments.

How do compliance laws affect day trading broker operations?

Compliance laws require day trading brokers to verify client identities, monitor transactions for suspicious activity, and report large or suspicious trades to authorities. They must follow regulations like anti-money laundering (AML) rules and know your customer (KYC) procedures. These laws limit risky trading practices, enforce capital requirements, and mandate transparent record-keeping. Brokers face penalties if they fail to adhere, which can impact their ability to operate, increase compliance costs, and lead to stricter oversight.

What licensing requirements must day trading brokers meet?

Day trading brokers must register with regulatory agencies like the SEC and FINRA, maintain proper licensing such as a Series 7 or Series 63, and follow strict compliance rules for anti-money laundering, customer protection, and reporting. They must implement robust internal controls, ensure transparent communication, and adhere to capital and net capital requirements to protect clients and maintain market integrity.

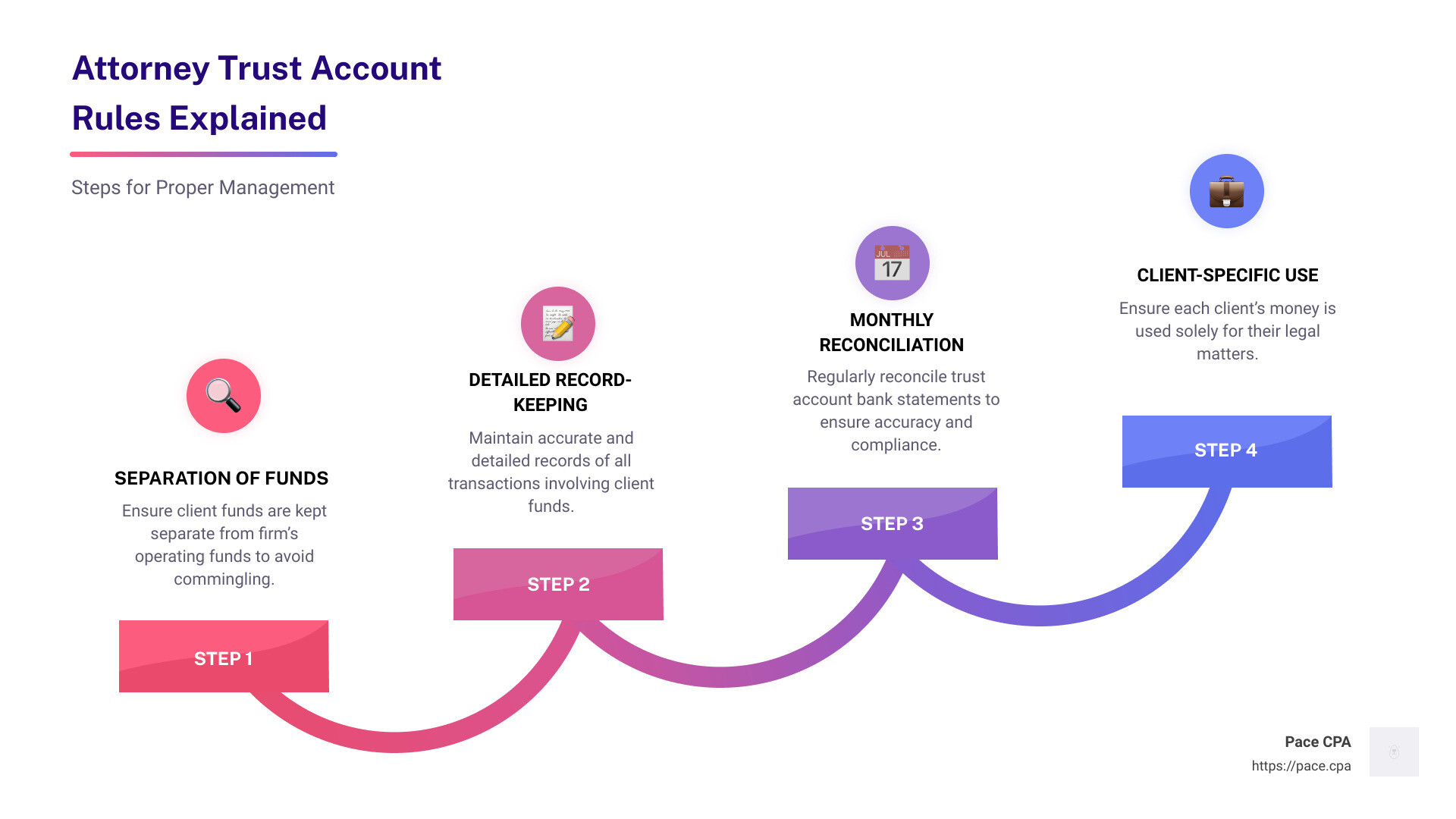

How do brokers ensure customer funds are protected under law?

Brokers protect customer funds by holding them in segregated accounts, separate from company assets, as mandated by law. They follow strict regulatory requirements to regularly audit and report fund holdings. Compliance laws also require brokers to maintain adequate capitalization and implement secure transfer protocols. These measures prevent misuse or commingling of client money, ensuring funds are available and protected if the broker faces financial trouble.

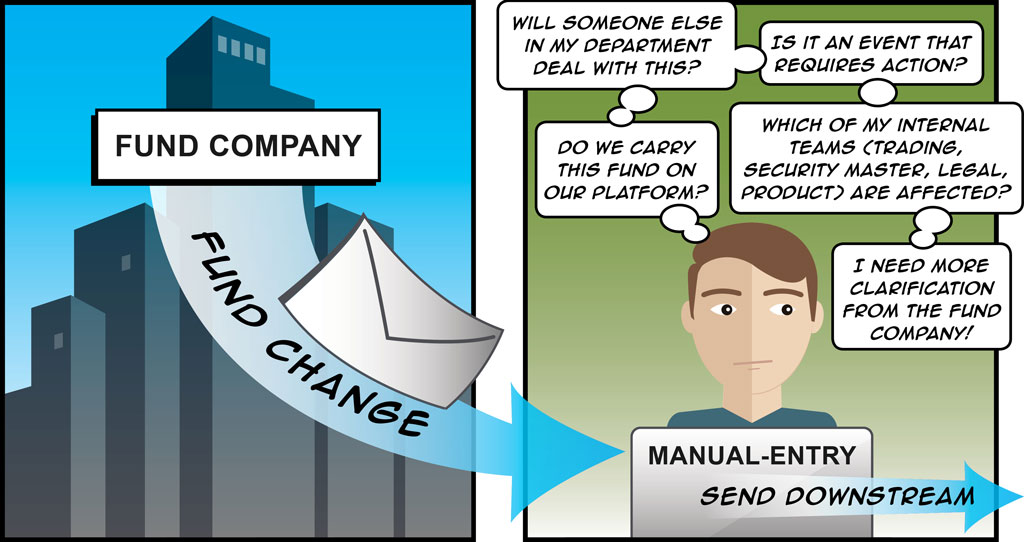

What reporting obligations do day trading brokers have?

Day trading brokers must report customer transactions, including large trades and suspicious activities, to regulatory authorities like the SEC and FINRA. They are required to file Form 13F for institutional holdings and submit anti-money laundering reports (e.g., CTRs). Brokers also report customer account details, trade confirmations, and any pattern of suspicious or manipulative trading to ensure compliance with securities laws.

How do brokers prevent money laundering and fraud?

Day trading brokers prevent money laundering and fraud by implementing strict KYC procedures, monitoring transactions for suspicious activity, adhering to AML regulations, and using advanced fraud detection tools. They verify client identities before account approval and track trading patterns to flag unusual behavior. Regular audits and compliance checks ensure they follow legal standards and report any suspicious transactions to authorities.

What record-keeping duties do day trading brokers have?

Day trading brokers must maintain detailed transaction records, including trade executions, order details, and client communications. They are responsible for recording client account activities, funds deposits and withdrawals, and ensuring a clear audit trail. Brokers must also keep records of compliance reports, customer identification, and any suspicious activity disclosures. These records must be stored securely and retained for a specified period, typically five years, to meet regulatory standards.

How must brokers disclose risks to clients under regulations?

Brokers must clearly explain the risks of day trading, including potential losses and market volatility, in a way clients understand. They are required to provide written disclosures detailing the risks involved before any trade, ensuring clients acknowledge these risks. Regulatory rules demand full transparency, so brokers must avoid misleading statements and emphasize that day trading can lead to significant financial loss. They should also inform clients about margin requirements and the possibility of margin calls.

What are the rules for managing client accounts legally?

Day trading brokers must follow strict KYC and AML regulations, ensure transparent fee disclosures, maintain accurate client records, and execute trades honestly. They can't manipulate markets or mislead clients. Brokers must verify client identities, report suspicious activities, and adhere to internal risk management standards. Compliance also requires proper supervision, secure data handling, and adherence to trading restrictions for high-risk clients.

How do brokers comply with anti-money laundering laws?

Day trading brokers comply with anti-money laundering laws by implementing customer identity verification (KYC), monitoring transactions for suspicious activity, reporting large or unusual transactions to authorities, maintaining detailed records, and training staff on AML procedures.

What are the penalties for non-compliance for brokers?

Penalties for non-compliance for brokers include hefty fines, license suspension or revocation, legal action, and potential criminal charges. They can also face damage to reputation and loss of trust from clients.

How do brokers handle insider trading regulations?

Day trading brokers handle insider trading regulations by implementing strict policies to detect and prevent illegal trading based on non-public information. They monitor client activity for suspicious trades, enforce disclosure requirements, and educate traders on legal boundaries. Brokers also maintain robust compliance programs, conduct regular audits, and report any suspicious activity to regulators to ensure adherence to insider trading laws.

What disclosures are required for brokerage commissions and fees?

Day trading brokers must clearly disclose all commissions and fees upfront, including per-trade costs, spreads, and any additional charges. These disclosures should be transparent, easily understandable, and provided before the client commits to a trade. Brokers also need to inform clients about how fees might impact profitability and ensure disclosures comply with regulatory standards like FINRA and SEC rules.

How do brokers verify client identities to meet legal standards?

Brokers verify client identities by collecting government-issued ID, proof of address, and performing Know Your Customer (KYC) checks. They use biometric verification, facial recognition, or document scanning to confirm identities. Additionally, they screen clients against anti-money laundering (AML) databases and conduct ongoing monitoring to detect suspicious activity.

What are the ethical obligations of day trading brokers?

Day trading brokers must ensure fair execution of trades, provide transparent fee structures, and adhere to anti-money laundering laws. They are responsible for accurately reporting client transactions and complying with regulations like the SEC and FINRA. Brokers should also warn clients about risks, prevent conflicts of interest, and maintain strict data security. Their obligation is to uphold market integrity and protect clients from deceptive practices.

Conclusion about What Are the Responsibilities of Day Trading Brokers Under Compliance Laws?

In summary, day trading brokers carry significant legal responsibilities under compliance laws that ensure the protection of customer funds, adherence to licensing requirements, and transparency in operations. They must implement rigorous measures to prevent fraud and money laundering while fulfilling extensive reporting and record-keeping obligations. By understanding these responsibilities, traders can navigate the complexities of the market with confidence. For more in-depth insights and guidance on day trading regulations, DayTradingBusiness is here to help.

Learn about What Are the Latest Changes in Day Trading Broker Compliance Laws?