Did you know that not following SEC and FINRA regulations can cost you more than a bad haircut at a budget salon? In the fast-paced world of trading, staying compliant with SEC and FINRA regulations is crucial for financial firms. This article outlines essential strategies for keeping up with regulatory updates, highlights key SEC requirements, and explains how FINRA oversees broker-dealers. We’ll also address common compliance challenges, the importance of an effective compliance program, and necessary training. Furthermore, we’ll explore recordkeeping practices, potential penalties for non-compliance, and how technology can simplify adherence to regulations. Finally, we’ll cover best practices for reporting, conducting internal audits, and managing conflicts of interest. For traders looking to navigate the regulatory landscape, DayTradingBusiness provides invaluable insights to ensure you remain on the right side of the law.

How can I stay updated on SEC and FINRA regulations?

Subscribe to the SEC and FINRA email alerts and newsletters. Follow their official websites daily for updates. Join industry associations and attend webinars on compliance. Use compliance software that tracks regulatory changes. Consult legal experts specializing in securities law regularly. Monitor trusted financial news outlets for breaking regulatory updates.

What are the key SEC requirements for financial firms?

Financial firms must register with the SEC, maintain accurate records, and file regular reports like 10-Ks and 10-Qs. They need to implement robust internal controls, have compliance programs, and conduct ongoing employee training. Disclosure of material information, adherence to anti-fraud rules, and supervision of registered representatives are mandatory. Firms also must file suspicious activity reports (SARs) and comply with SEC and FINRA regulations on advertising, ethics, and recordkeeping.

How does FINRA regulate broker-dealers?

FINRA regulates broker-dealers by establishing rules they must follow, conducting regular audits, and monitoring trading activity. It enforces compliance through examinations, disciplinary actions, and mandatory reporting. Broker-dealers must register with FINRA, implement internal controls, and adhere to conduct standards to avoid penalties.

What are common compliance challenges with SEC rules?

Common compliance challenges with SEC rules include keeping up with frequent rule changes, managing complex reporting requirements, ensuring data accuracy and security, preventing insider trading, and maintaining comprehensive records. Firms also struggle with implementing effective internal controls and training staff to stay current on evolving regulations.

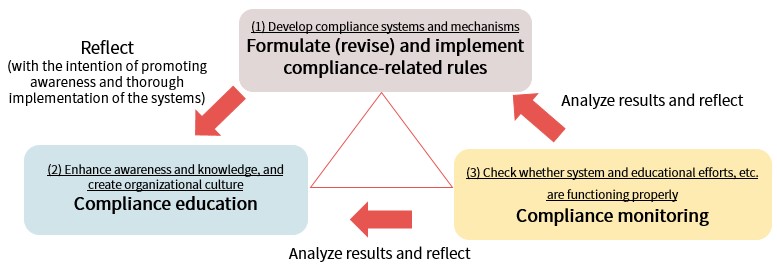

How can I develop an effective compliance program?

Create clear policies aligned with SEC and FINRA rules, train staff regularly, and monitor activities continuously. Implement strong internal controls, conduct audits, and stay updated on regulation changes. Use technology to track compliance, and foster a culture of transparency and accountability.

What training is necessary for SEC and FINRA compliance?

Complete training on SEC and FINRA regulations, including securities laws, ethical standards, and compliance procedures. Focus on firm policies, registration requirements, and reporting obligations. Regular updates on regulatory changes and scenario-based compliance exercises are essential. Many firms require ongoing coursework, seminars, or online modules to stay current.

How do I ensure proper recordkeeping for SEC and FINRA?

Maintain detailed, accurate records of all transactions, communications, and compliance activities. Use secure, organized recordkeeping systems that meet SEC and FINRA retention requirements—typically five years. Regularly review and update your policies to align with evolving regulations. Conduct internal audits to verify record accuracy. Train staff on proper documentation procedures. Keep audit trails clear and easily accessible for regulatory examinations.

What are the penalties for non-compliance with SEC rules?

Penalties for non-compliance with SEC rules include fines, suspension or bans from securities activities, disgorgement of profits, and criminal charges in severe cases.

How can technology help meet regulatory requirements?

Technology helps meet SEC and FINRA regulations by automating recordkeeping, ensuring accurate and timely data retention. It monitors trading activities for suspicious behavior, reducing compliance risks. Compliance software updates automatically with regulatory changes, keeping policies current. Secure platforms protect sensitive information, preventing data breaches. Real-time analytics identify potential violations before they escalate. Overall, tech streamlines compliance processes, reducing human error and increasing efficiency.

What are the best practices for reporting to SEC and FINRA?

Keep detailed records of all communications and transactions. Submit accurate, timely filings like Form 10-K, 10-Q, and annual reports. Follow strict internal controls and compliance programs. Monitor changes in regulations and implement necessary updates. Conduct regular training for staff on SEC and FINRA rules. Use compliant trading practices and disclose conflicts of interest. Maintain transparency and cooperate fully during audits or inquiries. Stay updated on regulatory guidance and promptly address any violations.

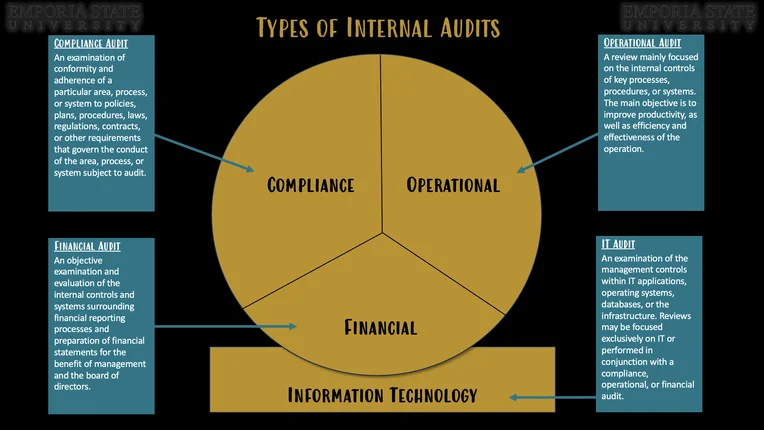

How do I handle internal audits for compliance?

Review policies regularly, document everything, and stay updated on SEC and FINRA rules. Conduct mock audits to spot issues early. Train staff on compliance standards and record-keeping. Prepare thorough, organized records of transactions, communications, and controls. Address any deficiencies immediately and implement corrective actions. Use checklists aligned with SEC and FINRA requirements to guide the audit process. Assign a compliance officer to oversee and coordinate audit readiness.

What should I include in my compliance policies and procedures?

Include clear guidelines on SEC and FINRA regulations, risk management protocols, employee conduct standards, recordkeeping requirements, reporting procedures, and training programs. Clearly define responsibilities, audit processes, and consequences for violations. Regularly update policies to reflect regulatory changes.

How can I prepare for SEC and FINRA examinations?

Review SEC and FINRA rules thoroughly, focusing on key compliance areas like anti-fraud measures, recordkeeping, and supervision. Conduct mock exams to identify gaps and familiarize yourself with exam formats. Keep detailed, organized records of all compliance policies and procedures. Train staff regularly on regulatory updates and ethical standards. Use internal audits to spot weaknesses before the exam. Stay updated on rule changes through official notices and industry news. Document your compliance efforts clearly to demonstrate strong internal controls.

What are the roles of compliance officers in regulatory adherence?

Compliance officers ensure firms follow SEC and FINRA rules by developing policies, monitoring activities, and conducting audits. They interpret complex regulations, train staff on compliance procedures, and investigate potential violations. Their role is to prevent breaches, report issues to regulators, and keep the firm aligned with evolving rules.

How do I manage conflicts of interest under SEC and FINRA rules?

Disclose any conflicts of interest promptly to your firm’s compliance department. Follow firm policies on conflict management, which may include recusal from decisions or disclosing conflicts to clients. Keep records of disclosures and actions taken. Regularly review your relationships and transactions to identify potential conflicts. Stay updated on SEC and FINRA rules through training and compliance alerts.

How can I resolve compliance violations effectively?

To resolve compliance violations effectively, identify the root cause immediately, document the issue thoroughly, and implement corrective actions that align with SEC and FINRA rules. Conduct a detailed internal review, notify regulators if required, and update policies to prevent recurrence. Train staff on compliance standards continuously, and monitor ongoing activities for adherence. Address violations transparently and promptly to restore compliance and trust.

Conclusion about How to Ensure Compliance with SEC & FINRA Regulations

In conclusion, staying compliant with SEC and FINRA regulations is crucial for financial firms to avoid penalties and maintain operational integrity. By developing a robust compliance program, investing in technology, and ensuring continuous training, firms can effectively navigate the complexities of regulatory requirements. Regular audits and clear compliance policies enhance transparency, while proactive conflict management fosters trust. For comprehensive support and insights into trading compliance, DayTradingBusiness is here to guide you every step of the way.

Learn about How to Ensure Your Broker is Compliant with SEC and FINRA Regulations