Did you know that day trading can sometimes feel like trying to juggle flaming torches while riding a unicycle? In the ever-evolving world of finance, staying compliant with the latest broker regulations is just as crucial. This article dives into the recent updates in day trading broker compliance laws, exploring how these changes impact brokers and traders alike. From new disclosure requirements to restrictions on leverage and margin trading, we cover the essential compliance challenges brokers face today. Additionally, learn about the implications of SEC and FINRA rule changes, the effects on broker-client communication, and the heightened standards for transparency and reporting obligations. For traders looking to navigate this complex landscape, understanding these regulations is key—let DayTradingBusiness guide you through it all.

What are the recent updates in day trading broker compliance laws?

Recent updates in day trading broker compliance laws include stricter requirements for client verification under KYC rules, enhanced transparency around order execution and fees, and tighter regulations on margin and leverage limits to protect retail traders. Several jurisdictions now enforce real-time reporting of trades to regulators and require brokers to implement better risk management protocols. Additionally, some regions have introduced mandatory educational resources for day traders to reduce reckless trading.

How have new regulations impacted day trading brokers?

New regulations have tightened capital requirements for day trading brokers, forcing them to hold more reserve funds. They now face stricter oversight on client account protections and transparency, making it harder to operate without robust compliance systems. These changes have led to increased costs and operational adjustments for brokers, reducing the number of smaller firms. Overall, brokers are more accountable, with tighter rules aimed at safeguarding traders but also raising the barrier to entry in the day trading industry.

What compliance requirements do day trading brokers face now?

Day trading brokers now face stricter compliance laws requiring higher capital reserves, enhanced anti-money laundering (AML) procedures, and real-time risk monitoring. They must adhere to updated FINRA and SEC rules, including stricter client verification (KYC) processes and disclosure requirements. New regulations also mandate more transparent fee structures and improved cybersecurity measures. Recent changes emphasize protecting retail traders from excessive leverage and ensuring fair trading practices.

Are there new rules for broker disclosures in day trading?

Yes, the SEC updated broker disclosure rules in 2023, requiring clearer explanations of day trading risks, margin requirements, and potential losses. Brokers must now provide more detailed, upfront disclosures about trading costs, leverage, and the risks of rapid trading strategies. These changes aim to improve transparency and help day traders understand the true risks involved.

How have SEC or FINRA rules changed for day trading brokers?

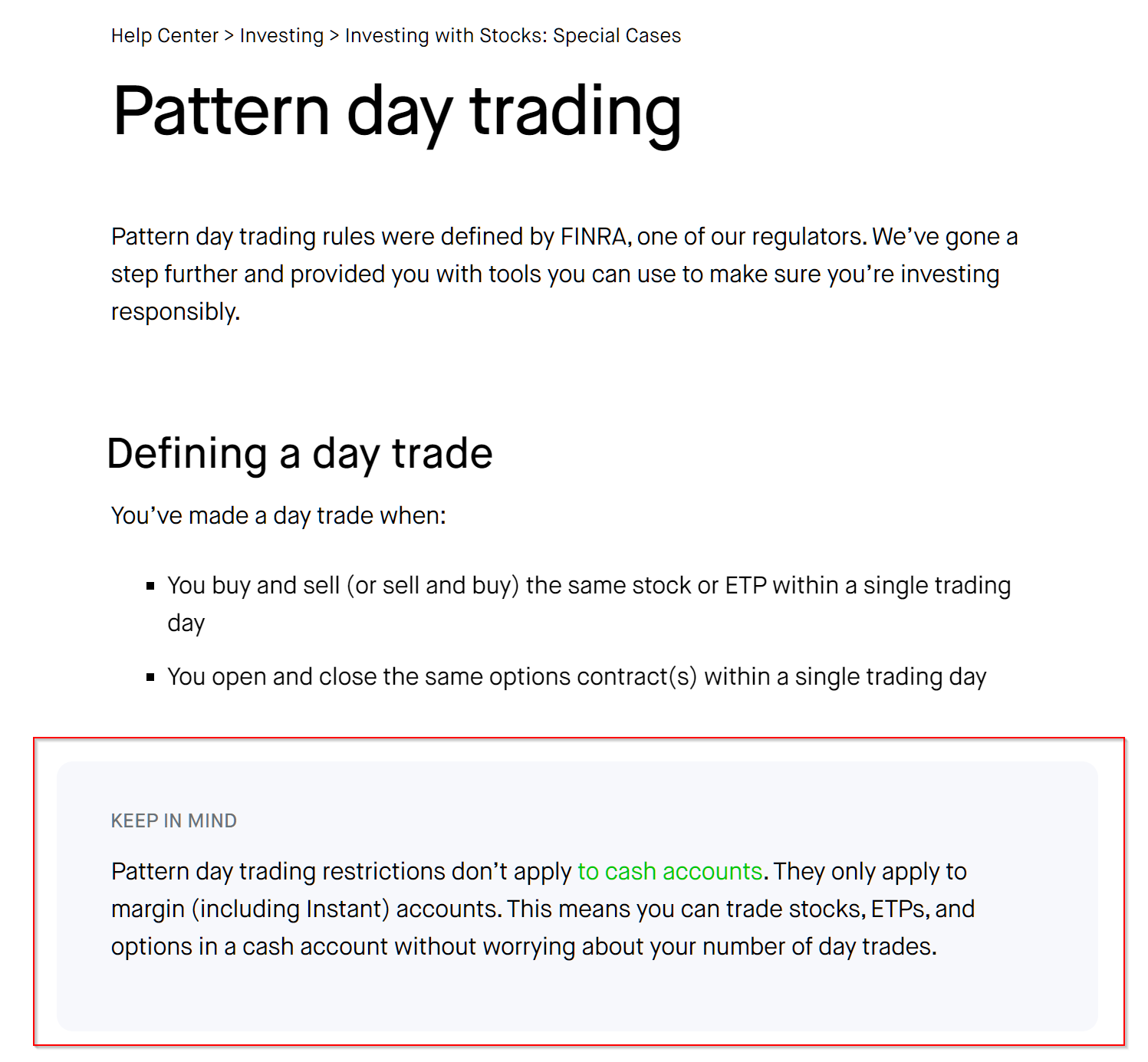

Recent SEC and FINRA rules now require day trading brokers to enforce a minimum equity of $25,000 for pattern day traders, tighten margin requirements, and implement stricter account monitoring. Brokers must also provide clearer disclosures about risks and the pattern day trader rule, along with enhanced supervision of high-frequency trading activities. These changes aim to reduce excessive risk-taking and protect retail traders.

What are the latest restrictions on leverage for day traders?

The latest restrictions limit day traders to a maximum leverage of 25:1 for major currency pairs and 20:1 for minor pairs. US regulators also require day traders to meet minimum equity of $25,000 and maintain margin levels accordingly. Brokers are tightening leverage to reduce risk, with some reducing it further during volatile periods.

How do recent laws affect broker reporting obligations?

Recent laws tighten broker reporting obligations by requiring more detailed transaction disclosures and real-time reporting. Brokers must now submit more comprehensive data on client trades, including larger volume trades and suspicious activity. These changes aim to enhance transparency, combat fraud, and improve market oversight, meaning brokers need upgraded systems and stricter compliance processes.

What compliance changes are there for margin trading?

Recent compliance changes for margin trading include stricter margin requirements, enhanced customer verification (KYC), and tighter restrictions on leverage ratios. Brokers must now implement more rigorous anti-money laundering measures and improve transparency around trading risks. Regulatory bodies also demand clearer disclosure of margin calls and potential losses, aiming to protect retail traders from excessive risk.

Are there new rules for broker-client communication?

Yes, recent updates require clearer disclosures about risks and fees, tighter supervision of communication channels like social media, and increased record-keeping for all broker-client interactions. Brokers must ensure transparency and prevent misleading information, especially on digital platforms.

How have anti-money laundering laws impacted day trading brokers?

Anti-money laundering laws have increased scrutiny on day trading brokers, requiring stricter customer verification and transaction monitoring. Brokers must now implement advanced KYC procedures, report suspicious activities, and maintain detailed records. These regulations have led to more rigorous onboarding processes, higher compliance costs, and tighter transaction limits to prevent money laundering.

Learn about How Do Anti-Money Laundering Laws Affect Day Traders?

What are the latest rules on broker audits and inspections?

The latest rules on broker audits and inspections tighten oversight on how brokers monitor day trading activity. Regulators now require more frequent and thorough compliance checks, focusing on ensuring brokers flag pattern day traders and enforce margin rules accurately. There’s increased scrutiny on brokers' risk management practices, with stricter documentation and reporting standards. Also, new guidelines emphasize transparency in disclosures about trading risks and account protections during inspections. Overall, the focus is on boosting investor protection and preventing misconduct through more rigorous and regular broker audits.

How do recent compliance laws affect broker licensing?

Recent compliance laws tighten broker licensing by requiring stricter background checks, increased transparency, and higher capital reserves. Brokers must now meet more rigorous standards for regulatory approval, often involving detailed disclosures and ongoing compliance audits. These changes aim to prevent fraud, protect investors, and ensure brokers adhere to updated standards, making licensing more challenging but safer for traders.

Learn about How Do Broker Compliance Rules Affect Day Trading Costs and Fees?

What are the new regulations on broker advertising and marketing?

Recent changes in broker advertising and marketing laws focus on transparency and honesty. Brokers must clearly disclose risks, fees, and potential conflicts of interest. They can’t make false claims about guaranteed profits or minimal risks. Promotions now require clear, conspicuous disclosures, especially around leverage and margin risks. The aim is to protect retail traders from misleading advertising and ensure they understand the true nature of day trading.

How have recent changes influenced broker transparency standards?

Recent changes have tightened broker transparency standards by requiring clearer disclosure of trading costs, risks, and conflicts of interest. Regulators now mandate more detailed reporting on order execution quality and fees, helping traders understand how brokers make money. These updates push brokers to be more upfront, reducing hidden fees and misleading practices. Overall, the latest compliance laws aim to boost trust and fairness in day trading by making broker operations more transparent.

What legal risks do day trading brokers face with new laws?

Day trading brokers face legal risks from new laws that tighten oversight on customer verification, anti-money laundering measures, and trading transparency. Non-compliance with updated registration and reporting requirements can lead to hefty fines and license revocations. Increased scrutiny of margin rules and leverage limits may result in legal action if brokers push clients beyond legal boundaries. Failing to adapt to new disclosure standards risks lawsuits and regulatory penalties. Overall, the latest compliance laws demand stricter internal controls, or brokers risk legal penalties and damage to reputation.

Learn about Legal Risks of Day Trading Forex and Crypto

Conclusion about What Are the Latest Changes in Day Trading Broker Compliance Laws?

In summary, the latest changes in day trading broker compliance laws have introduced stricter regulations that impact various aspects of trading operations, from leverage restrictions to enhanced transparency standards. Brokers must now navigate updated disclosure requirements, compliance obligations, and reporting duties to align with SEC and FINRA regulations. As these laws evolve, staying informed is crucial for both brokers and traders. For comprehensive insights and guidance on these developments, DayTradingBusiness remains a valuable resource for navigating the complexities of day trading compliance.

Learn about What Are the Responsibilities of Day Trading Brokers Under Compliance Laws?