Did you know that if you trade more than three times in a rolling five-day period, you might be labeled a "Pattern Day Trader" and face some serious restrictions? This article dives into the intricacies of the PDT rule, explaining what it is, when it applies, and who can bypass it. You'll discover how to avoid PDT restrictions, the differences between cash and margin accounts, and whether international traders can escape its clutches. Additionally, we’ll cover vital information on the risks of violating the rule, strategies for compliance, and broker-specific exceptions. Get ready to arm yourself with knowledge from DayTradingBusiness to navigate the complexities of day trading effectively!

What is the PDT rule in stock trading?

The PDT rule, or Pattern Day Trader rule, requires traders with less than $25,000 in their account to limit themselves to three day trades within five business days. An exception is if your account balance exceeds $25,000, then you can day trade freely. Additionally, using a cash account instead of a margin account exempts you from the PDT rule.

When does the PDT rule apply?

The PDT rule applies when you have less than $25,000 in your trading account and execute four or more day trades within five business days. Exceptions include if your account is a pattern day trader account, you have more than $25,000, or you're trading on a cash account without margin.

Who is exempt from the PDT rule?

The PDT rule exempts traders with more than $25,000 in their account, traders using a cash account, and traders who haven't executed four day trades in five business days. It also doesn't apply to certain institutional traders and traders approved for pattern day trading exemptions by brokers.

How do traders avoid PDT restrictions?

Traders avoid PDT restrictions by qualifying for exceptions like trading retirement accounts (IRAs), opening a second personal account if they meet pattern day trader criteria across multiple accounts, or trading futures or forex, which aren’t subject to PDT rules.

Can I trade more than three times a week without restrictions?

Yes, you can trade more than three times a week without restrictions if you have more than $25,000 in your account on any single day. This exception to the PDT rule is called the pattern day trader (PDT) exemption.

Are there accounts that bypass the PDT rule?

Yes, accounts that are registered as pattern day traders with a minimum of $25,000 in equity can bypass the PDT rule. Additionally, certain accounts like those in retirement plans or with a margin account that meet specific criteria might be exempt.

How do cash accounts differ from margin accounts regarding PDT?

Cash accounts aren’t subject to the Pattern Day Trader (PDT) rule because they don’t allow margin trading. Margin accounts trigger the PDT rule if you execute four or more day trades within five business days, provided your account equity is under $25,000. In cash accounts, you can day trade freely without PDT restrictions since trades are settled with your actual funds, not borrowed money.

What are the rules for pattern day traders?

The main exception to the Pattern Day Trader (PDT) rule is if your account has at least $25,000 in equity. Without that, you're restricted to four day trades in a five-business-day period. Other exceptions include trading in a cash account, where the PDT rule doesn't apply, or using options and futures accounts that aren't subject to the same pattern trading rules. Some broker-specific policies may also offer limited flexibility, but generally, the $25,000 minimum is the key threshold.

Does the PDT rule apply to futures or options trading?

No, the Pattern Day Trader (PDT) rule does not apply to futures or options trading. It only governs stock trading in margin accounts.

What is the role of a Pattern Day Trader waiver?

A Pattern Day Trader waiver exempts traders from the PDT rule, which requires maintaining $25,000 in account equity if they make four or more day trades in five business days. It allows traders to execute frequent day trades without meeting the minimum equity threshold, often for active traders with large accounts or those who qualify under specific broker policies.

Can international traders avoid the PDT rule?

Yes, international traders can avoid the PDT rule by opening a cash account, as the rule applies only to margin accounts in the U.S.. They’re not subject to the PDT rule if they trade with funds that aren’t margin-based or if they use international brokerage accounts not governed by U.S. regulations.

How does the PDT rule impact small or beginner traders?

The PDT rule limits small traders by requiring a minimum of $25,000 in account equity to day trade four or more times in five business days. For beginners with less capital, this means they can't execute multiple day trades without meeting the threshold, restricting quick, frequent trading and forcing them to hold positions overnight or limit trades. It often pushes new traders to either increase their account size or avoid day trading altogether, delaying their ability to practice active trading strategies.

Learn about How Does the PDT Rule Impact Small Account Traders?

Are there broker-specific exceptions to the PDT rule?

Yes, broker-specific exceptions to the PDT rule exist. Some brokers offer cash accounts or offshore accounts that aren’t subject to the pattern day trader regulation. Others allow traders to avoid the PDT rule if they maintain higher account balances, like $25,000 or more, or if they qualify for certain types of margin accounts. Always check with your broker, as their policies and exceptions can vary.

What are the risks of violating the PDT rule?

Violating the PDT rule can lead to account restrictions, like a 90-day trading halt, preventing you from day trading until you meet minimum equity requirements. If you violate it repeatedly, your broker may restrict or close your account. It also risks additional scrutiny from regulators, potentially leading to fines or other penalties.

How long is the PDT restriction period?

The PDT restriction period lasts for 90 days.

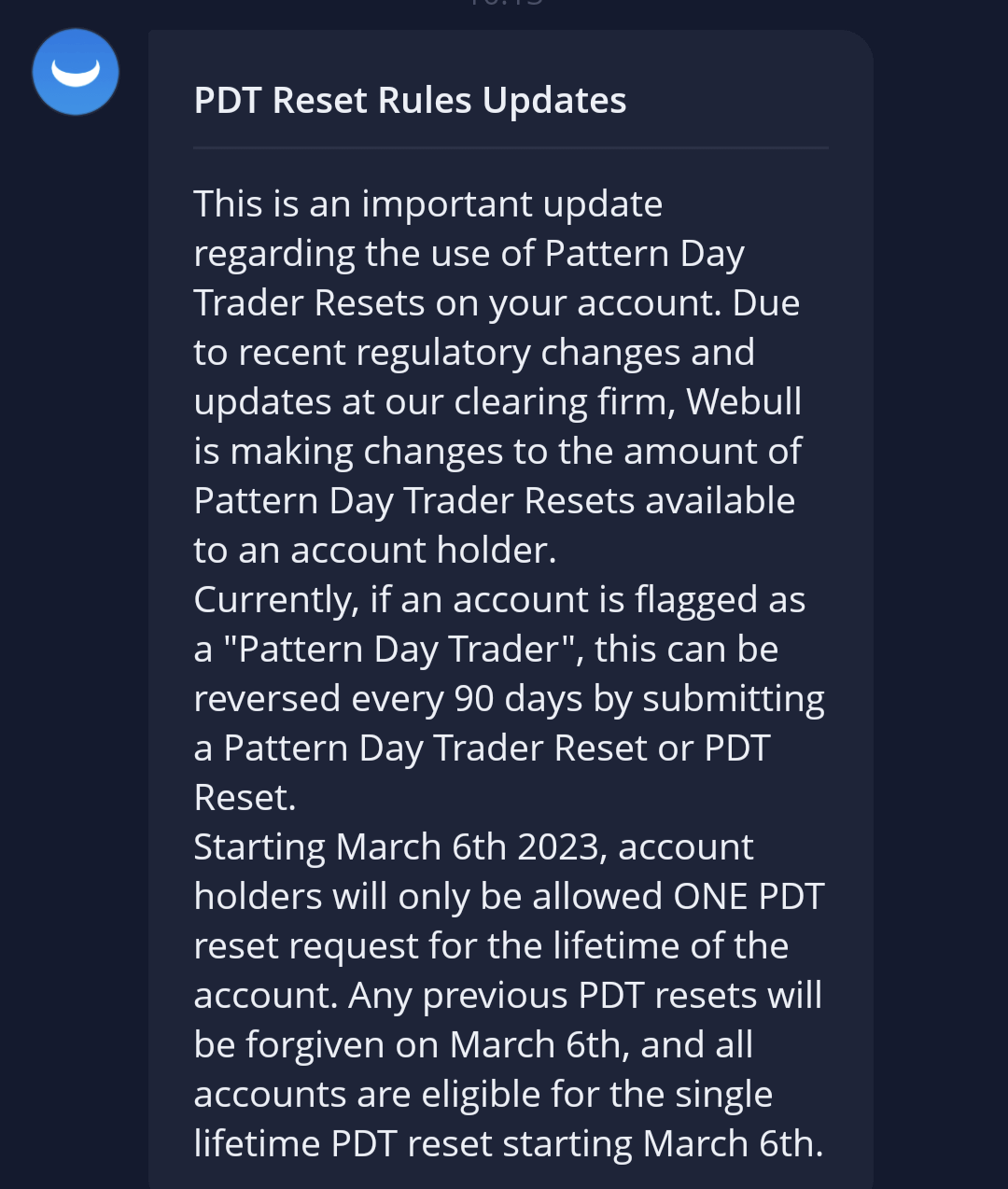

Can a trader reset their PDT status?

No, a trader can't reset their Pattern Day Trader (PDT) status once it's established. To remove PDT restrictions, they must wait 90 days without executing four or more day trades in five business days or meet other specific exemptions, like maintaining a minimum $25,000 account balance.

What strategies help traders stay compliant with PDT rules?

Traders stay compliant with PDT rules by using cash accounts instead of margin accounts, avoiding more than three day trades in five business days, and maintaining minimum equity of $25,000. They also spread trades over multiple accounts or focus on swing trading to reduce day trading frequency. Some use options or futures to sidestep PDT restrictions. Regular monitoring of trading activity and understanding the pattern day trader (PDT) definition helps avoid violations.

Conclusion about What Are the Exceptions to the PDT Rule?

Understanding the exceptions to the PDT rule is crucial for traders looking to navigate the complexities of day trading. By recognizing the various scenarios that allow for exemptions and the strategies to avoid restrictions, traders can optimize their trading practices without falling foul of regulations. For those seeking comprehensive guidance on trading strategies and rule compliance, DayTradingBusiness offers invaluable insights and resources to enhance your trading journey.

Sources:

- Central serous chorioretinopathy: Towards an evidence-based ...

- Impact Evaluation in Practice

- A Test for Linkage and Association in General Pedigrees: The ...

- State Constitutional Prohibitions of Slavery and Involuntary Servitude

- Patient and peer: Guideline design and expert response ...

- Factors that influence singlet oxygen formation vs. ligand ...