Did you know that in the stock market, the only constant is change—much like your favorite pair of socks? When navigating the unpredictable waves of volatile markets, adjusting your position size becomes crucial for safeguarding your investments. This article dives deep into essential strategies for determining the right position size during high volatility, considering factors like market swings, leverage, and account size. Learn how to effectively use stop-loss orders, avoid common pitfalls, and protect your capital while maximizing profit potential. With insights from DayTradingBusiness, you'll be equipped to manage your trading risk and optimize your approach in any market condition.

How can I determine the right position size during high volatility?

To determine the right position size during high volatility, calculate your risk per trade—usually 1-2% of your account—and adjust based on the wider stop-loss distance caused by volatility. Use the ATR (Average True Range) to gauge market swings and set your stop-loss accordingly, then divide your risk amount by the ATR-based stop-loss to find your position size. This keeps risk consistent despite unpredictable price swings.

What factors should I consider when adjusting position size in volatile markets?

When adjusting position size in volatile markets, consider market volatility levels, your risk tolerance, and the size of your stop-loss. Use wider stops to accommodate price swings, and reduce your position size to limit potential losses. Assess current market conditions, such as news events or economic reports, that can increase volatility. Always align your position with your overall risk management plan, ensuring no single trade risks more than a small percentage of your account.

How does market volatility impact my trading risk and position sizing?

Market volatility increases trading risk by causing larger price swings, which can quickly wipe out gains or trigger losses. To manage this risk, reduce your position size—trading smaller amounts limits exposure during unpredictable moves. Adjust your position sizing by applying tighter stop-losses and scaling back the number of contracts or shares you trade. This way, you protect your capital from sudden market swings and stay flexible to adapt as volatility shifts.

What are the best strategies for scaling down positions in volatile conditions?

Reduce your position size to limit risk. Use smaller trades to avoid heavy losses during sudden swings. Set tight stop-loss orders to exit quickly if the market moves against you. Consider scaling out—sell portions of your position as the market moves in your favor. Avoid adding to positions during high volatility; wait for calmer conditions. Use volatility indicators like the VIX to gauge when to tighten or loosen your positions. Stick to your risk management plan and avoid emotional decisions.

How can I use stop-loss orders to manage position size in volatile markets?

Set a stop-loss order at a price level that limits your potential loss based on your risk tolerance. Use tighter stop-losses in volatile markets to prevent large swings from wiping out your position. Adjust your position size so that the dollar amount risked with the stop-loss remains consistent, avoiding overexposure during high volatility. For example, if the market becomes more volatile, reduce your position size to keep your risk within your comfort zone. This way, stop-loss orders help control losses and prevent overcommitting when prices swing unpredictably.

When should I decrease my position size during market swings?

Decrease your position size when market swings cause increased volatility and uncertainty. If the market becomes unpredictable or shows sharp, rapid price movements, cut back to manage risk. Look to reduce your size when technical indicators signal overbought or oversold conditions, or if your stop-loss levels are hit frequently. This helps protect your capital from sudden downturns during volatile periods.

How do leverage and position size relate in volatile environments?

In volatile markets, reducing position size minimizes risk exposure, since asset prices swing wildly. Leverage amplifies these swings, so lowering leverage helps prevent large losses. Smaller positions and lower leverage together keep your portfolio more stable amid price swings. When volatility spikes, cut back on position size and leverage to avoid overexposure and protect capital.

What role does account size play in adjusting position size during volatility?

Account size determines how much you can risk per trade during volatility. Larger accounts can handle bigger position adjustments without risking too much of their capital. Smaller accounts need to reduce position size more aggressively to avoid overexposure. Essentially, bigger accounts have more buffer, allowing for more flexible position sizing amid market swings.

How can I avoid overexposure when markets are highly volatile?

Reduce your position size to limit risk during high volatility. Use smaller trades than usual to prevent large losses if the market swings unexpectedly. Set tighter stop-losses to cap potential downside. Avoid over-leveraging—trade with less leverage or none at all. Keep a close watch on market signals and be ready to exit quickly if conditions worsen.

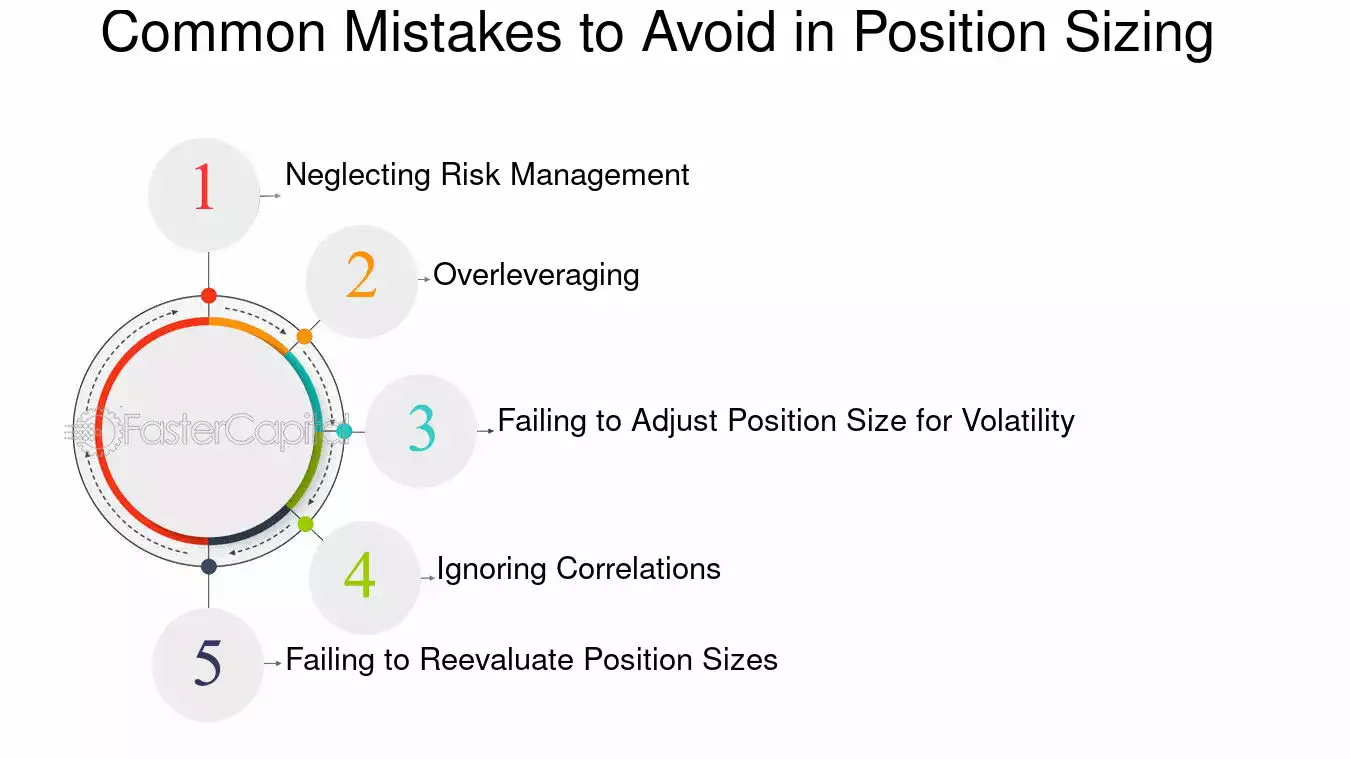

What are common mistakes traders make with position sizing in volatile markets?

Traders often underestimate volatility, leading to oversized positions that risk large losses. They ignore setting tighter stop-losses, which fail in sudden market swings. Overconfidence causes them to increase position size after small wins, amplifying risk during volatility spikes. Using fixed position sizes without adjusting for market swings results in disproportionate exposure. They also neglect proper risk-reward ratios, risking too much on unpredictable moves. Failing to diversify or hedge positions exposes them to sharp losses in volatile periods.

Learn about Common Mistakes in Position Sizing and How to Avoid Them

How does volatility affect my profit and loss potential?

Volatility increases your profit and loss potential by amplifying price swings. Larger swings mean higher gains if you catch moves correctly but also bigger losses if the market moves against you. Adjusting your position size downward during high volatility helps limit risk, preventing outsized losses from unpredictable market swings. Conversely, in calmer markets, larger positions can boost profit opportunities without excessive risk.

What tools or indicators can help me decide on position size?

Use tools like the Average True Range (ATR), volatility calculators, and position sizing formulas like the Kelly Criterion or fixed percentage method. Indicators like Bollinger Bands and the VIX gauge market volatility. Adjust position size based on ATR to limit risk during high volatility. Implement a fixed percentage rule—risk no more than 1-2% of your account per trade. Use volatility measures to reduce size when markets are unstable.

How can I set rules for position adjustments in unpredictable markets?

Set clear rules based on volatility indicators like ATR or VIX. Define specific percentage thresholds for increasing or decreasing your position size when volatility spikes. Use stop-loss levels tied to market swings to automatically reduce exposure. Incorporate dynamic scaling—adding or trimming positions as market conditions change. Avoid emotional decisions by automating rules through trading algorithms or preset instructions. Regularly review and adjust these rules to stay aligned with current market behavior.

What is the best way to protect my capital during volatile periods?

Reduce your position sizes to limit potential losses. Focus on smaller trades, diversify your portfolio, and set tighter stop-loss orders. Avoid over-leveraging and stay disciplined to prevent emotional decisions. This keeps your capital safer during market swings.

How often should I review and adjust my position sizes in fluctuating markets?

Review and adjust your position sizes weekly or whenever market volatility spikes significantly. Stay alert to price swings and economic news that can impact volatility, and modify your positions to manage risk accordingly.

Conclusion about How to Adjust Position Size During Volatile Markets

In volatile markets, adjusting your position size is crucial for managing risk and protecting your capital. Key factors include market conditions, account size, and the use of tools like stop-loss orders. Avoid common mistakes by establishing clear rules for position adjustments and regularly reviewing your trades. By understanding leverage and its impact on your trading strategy, you can better navigate market swings. For further guidance and insights, DayTradingBusiness is here to help you refine your approach to position sizing in unpredictable environments.

Learn about How to minimize stop-loss risk during volatile markets