Did you know that the SEC once considered changing the definition of a "pattern day trader" to include anyone who wears mismatched socks while trading? Just kidding—there’s no official sock policy! However, understanding the SEC's rules on pattern day trading is no laughing matter. This article breaks down essential concepts like what constitutes a pattern day trade, the capital requirements to avoid restrictions, and the consequences of non-compliance. We’ll also explore strategies, necessary tools, and how to legally navigate the world of day trading. For those eager to dive deeper, DayTradingBusiness offers the insights you need to master the market while staying within the SEC guidelines.

What is a pattern day trade?

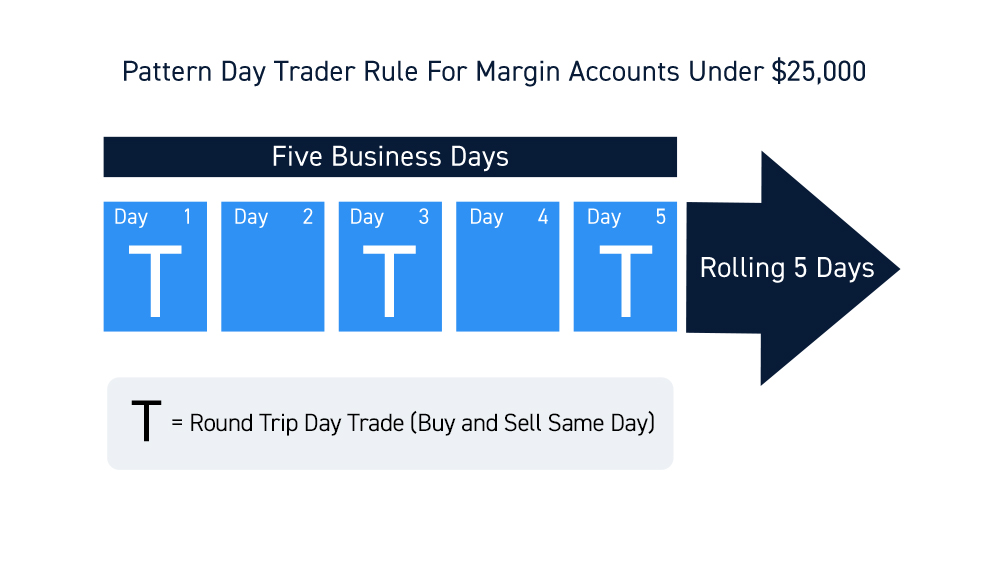

A pattern day trade is when you execute four or more day trades within five business days in a margin account, provided these trades account for more than 6% of your total trading activity that week. The SEC requires a minimum equity of $25,000 for pattern day traders. If you meet the criteria, you must maintain this minimum balance or face restrictions on trading.

How does the SEC define pattern day trading?

The SEC defines pattern day trading as executing four or more day trades within five business days in a margin account, provided those trades make up more than 6% of the account’s total trading activity during that period.

What are the rules for pattern day traders?

Pattern day traders must maintain a minimum of $25,000 in their margin account. They can execute four or more day trades within five business days, provided these trades make up more than 6% of their total trading activity. If they fall below $25,000, they face a 90-day trading restriction. They are also required to adhere to margin rules and margin call procedures if their account equity drops.

How much capital is required to avoid pattern day trading rules?

You need at least $25,000 in your trading account to avoid pattern day trading rules.

What happens if I violate pattern day trading rules?

If you violate pattern day trading rules, your brokerage will restrict your trading privileges, usually by limiting you to only closing trades for 90 days or until you meet minimum equity requirements of $25,000. You may also face a margin call and be required to deposit more funds. Repeated violations can lead to account suspension or permanent restrictions on pattern trading.

Can I do multiple day trades without restrictions?

No, you can't do multiple day trades without restrictions if your account falls below the $25,000 minimum. The SEC's pattern day trading rule requires maintaining $25,000 in your account to avoid restrictions. If your account dips below that, you'll face a 90-day trading ban on multiple day trades.

How is pattern day trading calculated?

Pattern day trading is calculated based on the number of day trades—buying and selling the same security within a single trading day—made in a five-business-day period. If you execute four or more day trades within five days, and these trades make up more than 6% of your total trading activity in that period, you're classified as a pattern day trader. Once flagged, you must maintain a minimum account balance of $25,000 to continue pattern day trading.

Are there exceptions to the pattern day trading rule?

Yes, there are exceptions. If your account has at least $25,000 in equity, you can avoid the pattern day trading rule. Also, traders using a cash account aren’t subject to the pattern day trading restrictions. Some brokers may offer limited exemptions or different rules for certain account types or trading strategies.

What are the risks of pattern day trading?

Pattern day trading risks include significant financial loss from frequent trades, margin calls if account equity drops below $25,000, increased emotional stress, and potential for impulsive decisions. It also limits trading flexibility and can lead to account restrictions if rules are broken.

How can I become a pattern day trader legally?

To become a legal pattern day trader, open a margin account with a broker that allows pattern day trading. Maintain a minimum equity of $25,000 in your account at all times. Execute four or more day trades within five business days, and your broker will classify you as a pattern day trader under SEC rules. Follow the SEC and FINRA regulations, and ensure you meet the minimum equity requirement to avoid account restrictions.

Learn about How to Transition from Pattern Day Trader to Longer-Term Trading?

What are the best strategies for pattern day traders?

Use at least $25,000 in your trading account to avoid restrictions. Focus on quick entry and exit to capitalize on small price moves. Maintain disciplined risk management, setting stop-loss orders for every trade. Limit yourself to four or fewer day trades within five business days. Keep detailed records of trades to stay compliant with SEC pattern day trading rules. Consider swing trading if you can't meet the minimum equity requirement. Stay informed on SEC regulations to avoid account restrictions.

How do margin requirements relate to pattern day trading?

Margin requirements are stricter for pattern day traders, requiring at least $25,000 in your trading account. If your account falls below this, you can't make more than three day trades in five business days. This rule aims to limit excessive leverage and protect traders from significant losses.

Learn about How to Transition from Pattern Day Trader to Longer-Term Trading?

What tools or platforms are best for pattern day trading?

Thinkorswim, Interactive Brokers, and TradeStation are top platforms for pattern day trading. They offer advanced charting, real-time data, and quick order execution. The SEC rules require a minimum $25,000 account balance for pattern day trading, so choose platforms that support margin trading within that limit. Thinkorswim by TD Ameritrade is popular for its user-friendly interface and robust tools. Interactive Brokers provides low commissions and extensive market access. TradeStation is known for its powerful analytics and customization options.

Learn about What Are the Best AI Tools for Day Trading?

How can I monitor my pattern day trading activity?

Use your broker’s trading platform to track your daily trades, as they usually flag pattern day trades automatically. Check your account statements regularly for the number of day trades you make in a rolling five-business-day period. Many brokers provide alerts or dashboards that notify you when you're approaching the four-day limit for pattern day trading. Keep an eye on your trading activity to avoid exceeding the SEC’s pattern day trading rules, which require maintaining at least $25,000 in your account if you execute four or more day trades within five days.

Learn about How Do Brokers Track and Report Day Trading Activity?

What are the penalties for not complying with SEC rules?

The penalties for not complying with SEC rules on pattern day trading include account restriction to a $2,000 minimum balance, suspension of trading privileges, fines, and potential account liquidation. Repeat violations can lead to longer restrictions or permanent bans from pattern day trading.

Conclusion about SEC Rules on Pattern Day Trading Explained

Understanding the SEC's rules on pattern day trading is crucial for anyone looking to navigate this complex trading landscape. By adhering to the defined regulations, meeting capital requirements, and utilizing effective strategies and tools, traders can engage in pattern day trading legally and successfully. Violating these rules can lead to significant penalties, making compliance essential. For those eager to optimize their trading experience, DayTradingBusiness offers valuable insights and resources to enhance your trading journey.

Learn about SEC & FINRA Rules on Disclosure and Transparency in Day Trading