Did you know that in the world of day trading, the only thing moving faster than stock prices might just be the rules regulating them? This article dives deep into how FINRA oversees day trading operations, exploring its regulatory framework, the specific rules enforced, and how compliance is monitored. Learn about the requirements day traders must meet, the penalties for violations, and the crucial disclosures required by FINRA. We also cover how FINRA ensures fair trading practices, coordinates with other regulators, and offers resources for traders. Whether you're a seasoned trader or just starting out, understanding FINRA's role is essential for navigating the fast-paced world of day trading, and DayTradingBusiness is here to guide you through it all.

How does FINRA regulate day trading activities?

FINRA regulates day trading by setting rules for margin accounts, requiring registration for active traders, monitoring trading activity for suspicious patterns, and enforcing compliance through audits and disciplinary actions.

What rules does FINRA enforce for day traders?

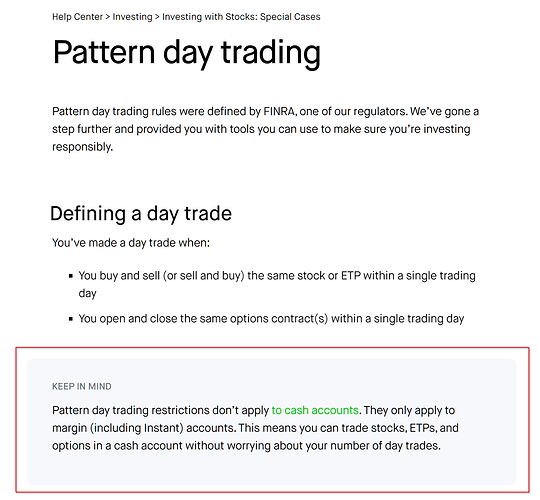

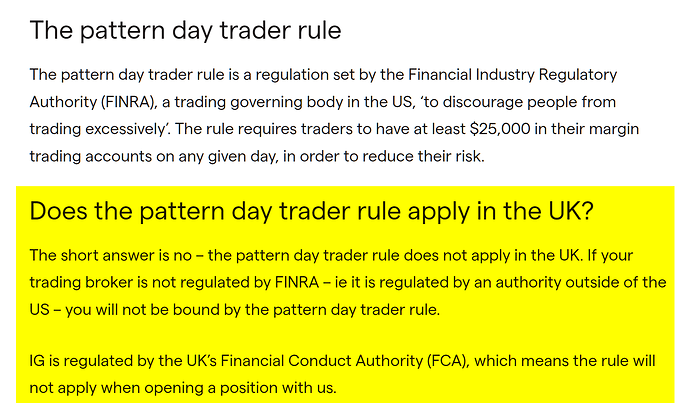

FINRA enforces rules requiring day traders to maintain a minimum account equity of $25,000, known as the Pattern Day Trader (PDT) rule. They monitor trading activity to prevent excessive day trading that could risk investor protection. FINRA also mandates proper risk disclosures, adherence to margin requirements, and accurate record-keeping. If a trader falls below $25,000, FINRA restricts them from executing four or more day trades within five business days until the account is restored.

How does FINRA monitor day trading accounts?

FINRA monitors day trading accounts through real-time trade surveillance, analyzing patterns for excessive buying and selling, and flagging suspicious activity. They review account activity for pattern day trading violations, ensuring traders meet minimum equity requirements. FINRA also audits broker-dealers’ compliance programs and investigates irregular trading behaviors to prevent market manipulation. Automated systems detect rapid trade executions typical of day trading, and they review customer accounts for pattern day trader status.

What are FINRA’s requirements for day trading compliance?

FINRA requires day traders to maintain minimum equity of $25,000 in their margin accounts, adhere to pattern day trader rules, and follow strict recordkeeping. They monitor trading activity for pattern day trading, enforce margin rules, and conduct regular reviews to ensure compliance. Firms must also implement policies to detect and prevent violations, reporting suspicious activity to FINRA.

How does FINRA handle violations by day traders?

FINRA monitors day traders through their broker-dealer firms, enforcing rules on pattern day trading, margin requirements, and trading disclosures. They review trading activity for violations like excessive trading, misleading practices, or failure to meet minimum equity requirements. If violations occur, FINRA can impose fines, suspend trading privileges, or require additional compliance measures for the trader or firm.

What disclosures must day traders provide to FINRA?

Day traders must disclose their trading activity, including their pattern of day trading, to FINRA. They need to provide accurate information about their trading account status, financial resources, and experience. If they meet the pattern day trader criteria, they must maintain a minimum equity of $25,000 in their account and disclose this to their broker, who reports it to FINRA.

How does FINRA ensure fair trading practices?

FINRA enforces fair trading by regulating broker-dealers, monitoring trading activities, and investigating suspicious transactions. It sets strict rules on order executions, transparency, and conflict of interest disclosures. FINRA audits firms regularly and uses advanced surveillance tools to detect manipulative behaviors like insider trading or pump-and-dump schemes. When misconduct occurs, it imposes fines, sanctions, or bans to maintain market integrity. It also educates traders and firms on compliance standards, promoting honest trading practices in day trading operations.

What penalties can FINRA impose on day traders?

FINRA can impose fines, suspension, or banning orders on day traders for violations like misleading practices, excessive trading, or failure to meet regulatory requirements. They may also revoke licenses or bar traders from the industry if violations are serious.

How does FINRA coordinate with other regulators on day trading?

FINRA coordinates with SEC and other regulators through information sharing, joint enforcement actions, and regulatory updates to monitor and oversee day trading activities. It collaborates on rule enforcement, data analysis, and investigations to prevent fraud and ensure compliance in day trading.

What training or education does FINRA require for day traders?

FINRA doesn't require specific training or education for day traders. Instead, it oversees their activities through regulations, licensing, and monitoring. If day traders operate as registered representatives or sell securities, they must pass FINRA exams like the Series 7 and Series 63. These licensing exams ensure they understand securities rules and compliance. FINRA also enforces rules on pattern day trading, margin use, and fraud, aiming to protect investors and maintain market integrity.

How does FINRA track suspicious day trading patterns?

FINRA monitors day trading by analyzing trading patterns for rapid, frequent buy-and-sell activities that deviate from normal behavior. It uses real-time surveillance tools to flag unusual volume spikes, pattern changes, and excessive short-term trading. When suspicious activity emerges, FINRA investigates for potential rule violations, such as market manipulation or excessive risk-taking. It also reviews trader accounts, communication, and order flow to catch patterns indicating illegal or risky day trading.

Learn about How Do SEC and FINRA Regulations Influence Day Trading Strategies?

Can FINRA revoke licenses for day trading misconduct?

Yes, FINRA can revoke licenses for day trading misconduct. It oversees day trading by investigating violations of securities rules, enforcing disciplinary actions like license revocations, fines, and bans for unethical or illegal trading behavior.

How does FINRA update rules related to day trading?

FINRA updates rules related to day trading by reviewing market practices, analyzing trader behavior, and implementing new regulations to address risks like pattern day trading. It conducts rule proposals, solicits public comment, and revises guidelines to ensure traders follow margin requirements, limit excessive trading, and prevent fraud. FINRA also monitors trading activity through surveillance systems to enforce these rules and protect investors.

Learn about How Do FINRA Rules Protect Day Traders?

What resources does FINRA offer for day traders?

FINRA provides educational resources on day trading risks, rules for pattern day traders, and guides on complying with margin requirements. It also offers investor alerts, regulatory notices, and tools like BrokerCheck to review brokerage firms. FINRA oversees day trading through monitoring trading activity, enforcing rules against misconduct, and ensuring brokers follow registration standards.

How does FINRA protect investors from risky day trading?

FINRA oversees day trading by setting rules to ensure brokers verify customer suitability, monitor for excessive risk, and enforce margin requirements. It audits broker practices, investigates misconduct, and enforces penalties for violations. FINRA also requires firms to implement risk management controls and educates investors about day trading risks.

Learn about How to Transition from Pattern Day Trader to Longer-Term Trading?

Conclusion about How does FINRA oversee day trading operations?

In summary, FINRA plays a crucial role in overseeing day trading operations by enforcing regulations, monitoring accounts, and ensuring compliance with specific rules. Its collaborative efforts with other regulators help maintain fair trading practices while providing resources and education for day traders. Understanding these guidelines is essential for anyone looking to navigate the complexities of day trading successfully. For further insights and support, consider exploring the resources offered by DayTradingBusiness.

Learn about How Do SEC and FINRA Regulations Influence Day Trading Strategies?

Sources:

- Speech by Governor Brainard on the structure of the Treasury market

- Market Liquidity after the Financial Crisis

- BPCE/Natixis US Resolution Plan Public Section

- Comparing European and US Securities Regulations

- BPCE/Natixis 2018 US Resolution Plan Public Section

- The Fed - Comprehensive Capital and Analysis Review and Dodd ...