Did you know that trading on margin is like borrowing your neighbor's lawnmower—exciting, but you better know the rules! In this article, we dive into the crucial regulations governing margin use in day trading, particularly in the U.S. We explore key regulations, the roles of the SEC and FINRA, and the impact of Regulation T on margin trading. You'll learn about minimum initial and maintenance margin requirements, leverage limits, and how margin calls function. We also discuss the specific rules for pattern day traders, penalties for violations, and how these rules differ internationally. Plus, discover if you can use borrowed funds for overnight positions and the necessary documentation for opening a margin account. Stay informed with insights from DayTradingBusiness to optimize your trading strategies while navigating these essential regulations.

What are the key regulations on margin trading in the US?

In the US, the key regulation for margin trading in day trading is FINRA Rule 4210, which sets margin requirements and leverage limits. The Federal Reserve's Regulation T mandates a 25% initial margin for stock purchases, meaning you can borrow up to 75%. The Pattern Day Trader rule requires maintaining at least $25,000 in your trading account if you execute four or more day trades within five business days. Brokerages often enforce these rules, and violating them can result in account restrictions or forced liquidation.

How does the SEC regulate margin requirements for day traders?

The SEC regulates margin requirements for day traders through the Federal Reserve Board’s Regulation T, which sets the minimum initial margin—typically 50% of the purchase price. The SEC also enforces rules through FINRA, which can impose higher margin requirements and set maintenance margin levels, usually around 25%. These rules ensure traders have enough equity in their accounts to cover potential losses, and brokerages must adhere to these standards when approving margin trades.

What is the role of FINRA in margin trading rules?

FINRA enforces rules on margin trading, including minimum equity requirements, margin calls, and disclosure obligations. It oversees broker-dealers to ensure they follow standards that protect investors from excessive leverage and risky trading behaviors. FINRA's regulations define how much traders can borrow, when margin calls happen, and how brokers must inform clients about margin risks.

How does Regulation T affect margin use for day traders?

Regulation T limits initial margin for day traders to 25%, meaning they must fund at least 25% of the purchase with their own money. It also requires that pattern day traders maintain a minimum equity of $25,000 in their margin account. If the account drops below this, trading restrictions kick in until the balance is restored.

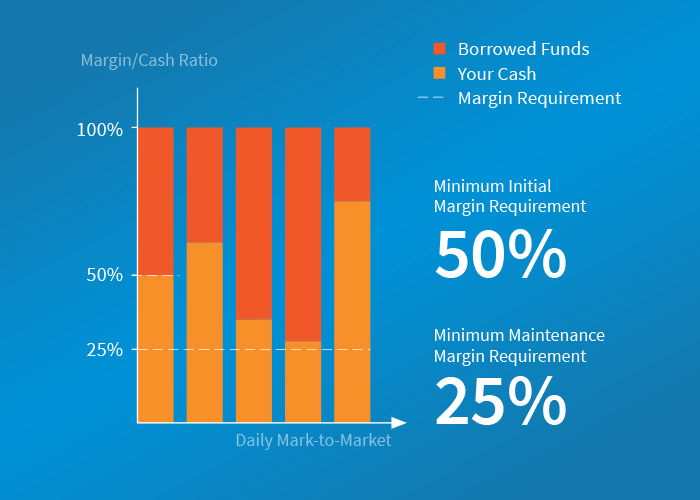

What are the minimum initial margin requirements?

The minimum initial margin requirement for day trading is typically set at 25% of the total trade value by the SEC and FINRA rules. The Federal Reserve’s Regulation T allows brokers to lend up to 50% of the purchase price, but day traders often need to meet the 25% requirement to open and maintain positions.

How are maintenance margins enforced in day trading?

Maintenance margins in day trading are enforced by brokerage firms and regulated by the SEC and FINRA. Brokers require traders to keep a minimum amount of equity in their accounts after opening a position. If the account equity falls below the maintenance margin level, the broker issues a margin call, demanding the trader deposit more funds or liquidate positions. Failure to meet the margin call results in the broker automatically selling securities to restore compliance. These regulations ensure traders maintain sufficient collateral and prevent excessive risk.

What are the leverage limits for margin accounts?

The leverage limits for margin accounts in day trading are set by FINRA and the SEC. Pattern day traders must maintain a minimum equity of $25,000. They can use up to 4:1 leverage on margin accounts, meaning they can borrow four times their account equity for day trading. For non-pattern traders, the Federal Reserve's Regulation T allows a maximum of 50% initial margin, or 2:1 leverage.

How do margin calls work during day trading?

Margin calls in day trading happen when your account’s equity falls below the broker’s maintenance margin. The broker then demands you deposit more funds or securities to cover the shortfall. If you don’t meet the margin call quickly, the broker can liquidate your positions to limit their risk. Regulations, like FINRA and SEC rules, require brokers to set minimum margin levels and notify traders of margin requirements. The Federal Reserve’s Regulation T also limits initial margin to 50% of the purchase price for stocks. Overall, brokers enforce margin rules to ensure traders maintain sufficient funds and prevent excessive risk.

Are there specific rules for pattern day traders?

Yes, pattern day traders must maintain a minimum equity of $25,000 in their margin account. They can only execute four or more day trades within five business days, using margin, without risking account restrictions. If they fall below $25,000, they face a 90-day trading restriction. The SEC and FINRA enforce these rules to limit excessive leverage and protect investors.

What penalties exist for violating margin regulations?

Penalties for violating margin regulations include hefty fines, account restrictions, forced liquidation of positions, and suspension from trading. Regulatory bodies like the SEC and FINRA can impose legal action, and brokers may close accounts or refuse future margin trading.

How do margin rules differ between US and international markets?

US margin rules require a minimum initial deposit of $25,000 for pattern day traders and set specific maintenance margins, typically 25% of the total position value. International markets vary widely; some have higher or lower margin requirements, with less strict rules on day trading frequency. For example, the UK’s FCA allows margin levels up to 50%, while Australia’s ASX sets margin requirements based on the broker’s policies, often between 25-50%. US rules focus on protecting retail traders with strict minimums, whereas international rules depend on local regulations and broker standards, leading to more variability outside the US.

Can you use borrowed funds for overnight positions?

Yes, you can use borrowed funds, or margin, for overnight positions, but regulations limit how much margin you can use and require maintenance minimums.

What documentation is needed to open a margin account?

To open a margin account, you'll need proof of identity (like a driver's license or passport), proof of address (utility bill or bank statement), and your Social Security number or tax ID.

How do margin rules impact day trading strategies?

Margin rules limit how much traders can borrow, enforcing minimum equity levels and maintenance margins. These regulations prevent over-leverage, reducing the risk of rapid losses during volatile day trades. They require traders to have a certain amount of their own money in the account before borrowing more. Margin rules also trigger margin calls if equity falls below set thresholds, forcing traders to liquidate positions. Overall, these rules shape day trading strategies by controlling leverage, encouraging careful risk management, and preventing reckless trading.

Learn about How do SEC rules impact day trading activities?

What changes are expected in margin regulations?

Expected changes in margin regulations may include higher margin requirements, stricter oversight on leverage, and tighter rules on initial and maintenance margin levels. Regulators might limit the amount of leverage allowed to reduce risk, especially during volatile markets. They could also implement more frequent margin calls and enhance transparency around margin use. Overall, these updates aim to protect traders from excessive risk and ensure market stability.

Conclusion about What regulations govern margin use in day trading?

Understanding the regulations governing margin use in day trading is essential for effective trading strategies and risk management. Key regulations enforced by the SEC and FINRA, alongside specific requirements like Regulation T, dictate how traders can leverage their capital. Awareness of margin calls, pattern day trader rules, and potential penalties for violations is crucial to maintaining compliance. As the landscape of margin regulations continues to evolve, staying updated is vital for success. For comprehensive insights and guidance on navigating these regulations, DayTradingBusiness is your go-to resource.

Sources:

- Margin Requirements, Volatility, and Market Integrity: What have we ...

- Margin and Capital Requirements for Covered Swap Entities

- Interagency Supervisory Guidance on Counterparty Credit Risk ...

- A Brief History of the 1987 Stock Market Crash with a Discussion of ...

- Speech by Governor Brainard on the structure of the Treasury market

- Comments on Regulatory capital rule: Amendments applicable to ...