Did you know that the IRS once mistook a trader’s profits for a typo and almost sent them a refund check for a million dollars? While that might be a funny oversight, navigating the tax implications of day trading is no joke. This article dives into the essentials of calculating taxable income from day trading, covering key aspects such as gross profit determination, deductible expenses, and the impact of short-term gains. You'll learn how to accurately calculate net profit, manage trading fees, and handle wash sales—all crucial for compliance. With insights on recordkeeping, tax rates, and strategies to minimize your tax burden, DayTradingBusiness equips you with the knowledge to keep your trading profitable and hassle-free.

What is taxable income in day trading?

Taxable income in day trading is the profit remaining after deducting all trading-related expenses and losses from your gross trading gains. It includes net gains from buying and selling securities within the tax year, such as stocks, options, or futures, reported on Schedule C or Form 8949. It doesn't count unrealized gains; only realized profits are taxable.

How do I determine my gross profit from day trading?

Subtract your total trading expenses and cost basis from your total trading gains. This gives your gross profit from day trading. For example, if you made $10,000 in gains and spent $1,000 on trading fees and related costs, your gross profit is $9,000.

What expenses can I deduct from my day trading income?

You can deduct expenses like trading platform fees, software subscriptions, internet costs, home office expenses, research materials, and educational courses related to day trading. Keep records of any travel costs for trading seminars or meetings. Office supplies, phone bills, and data services directly used for trading are also deductible.

How do I calculate net profit in day trading?

Subtract all trading expenses, commissions, and losses from your total trading gains. The resulting amount is your net profit, which is your taxable income from day trading.

What are the tax implications of short-term gains?

Short-term gains from day trading are taxed as ordinary income at your regular income tax rate. You must report these gains on your tax return, typically on Schedule D and Form 8949. The IRS considers holdings under one year as short-term, so profits from such trades are taxed immediately, potentially at higher rates than long-term capital gains.

How do I account for trading commissions and fees?

Subtract trading commissions and fees from your total gains when calculating taxable income from day trading. Include all brokerage fees, transaction costs, and other related expenses to get an accurate net profit. This ensures your taxable income reflects the true profit after trading costs.

Can I offset losses against gains in day trading?

Yes, you can offset losses against gains in day trading. Report your trading gains and losses on IRS Schedule D or Form 8949. If your losses exceed gains, you can deduct up to $3,000 ($1,500 if married filing separately) from other income, with remaining losses carried forward to future years.

How do I handle wash sales for tax purposes?

To handle wash sales for tax purposes, track your losing trades and identify if you repurchase the same or substantially identical security within 30 days before or after the sale. If so, disallow the loss and add it to the cost basis of the new purchase. Use IRS Form 8949 and Schedule D to report these adjustments. Keep detailed records of all trades, dates, and prices to accurately calculate your adjusted gains and losses.

What forms do I need to report day trading income?

Use Schedule C (Form 1040) for reporting day trading income if you qualify as a trader. If you’re considered an investor, report gains on Schedule D or Form 8949. For income from trading futures or commodities, report on Form 6781. If you're a trader with significant expenses, you might also need Schedule C to deduct those costs.

How do I differentiate between investment income and trading income?

Investment income comes from holding assets like stocks or bonds for the long term, earning dividends or interest. Trading income results from frequent buying and selling, aiming for short-term profits, and is considered active income. For tax purposes, investment income is usually taxed as capital gains or dividends, while trading income is treated as ordinary income. To differentiate, ask if your activity is long-term investing or frequent trading with a focus on short-term gains. If you hold assets for more than a year, it’s likely investment income; if you trade often, it’s trading income.

What is the tax rate for day trading profits?

In the U.S., day trading profits are taxed as ordinary income, with rates ranging from 10% to 37%, depending on your total taxable income.

How do I track my trades for tax reporting?

Use a trading journal or software to record every trade’s details—date, size, entry and exit points, and fees. Track your realized gains and losses from closing positions. Maintain a separate record of your holding periods to distinguish short-term from long-term gains. Summarize your net profit or loss for the tax year from these records. Convert your trading activity into a clear profit/loss statement to report on Schedule D or your tax forms. Keep receipts, brokerage statements, and trade logs organized for audit-proofing.

What are the recordkeeping requirements for day traders?

Day traders must keep detailed records of all trades, including dates, prices, quantities, commissions, and the reasons for each trade. Maintain a trading journal with timestamps, notes on trade rationale, and the gain or loss for each transaction. Save all brokerage statements, trade confirmations, and monthly summaries. Track expenses related to trading, like software and data feeds. These records are essential for accurately calculating taxable income and supporting IRS audits.

How do I estimate quarterly taxes on day trading gains?

To estimate quarterly taxes on day trading gains, calculate your net profit by subtracting trading expenses from your gross gains. Use your previous year's trading income as a baseline or estimate your expected gains for the quarter. Multiply your estimated net profit by your tax rate (consider short-term capital gains rates) to find your quarterly tax liability. Divide that amount by four for each quarterly payment. Adjust estimates if your trading activity or income changes.

Are there specific tax strategies for day traders?

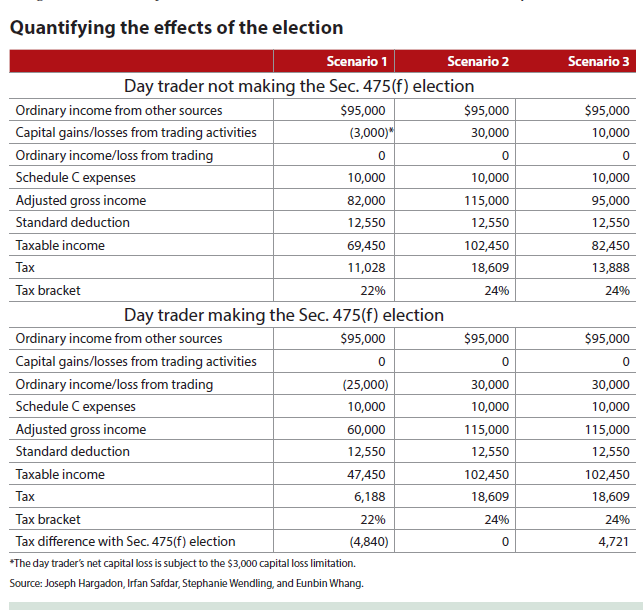

Yes, day traders can use mark-to-market accounting to treat gains and losses as ordinary income and losses, avoiding the wash sale rule. They can also elect Section 475(f) to mark-to-market their trading positions annually, which simplifies tax calculations. Additionally, tracking all trading expenses—like software, data feeds, and education—can offset gains. Using a dedicated trader tax status allows for more favorable tax treatment, but requires meeting specific trading activity criteria.

Learn about Are there specific taxation laws for day traders?

How does the mark-to-market accounting method affect taxable income?

Mark-to-market accounting resets gains and losses to market value at year-end, which means all unrealized gains and losses become realized. This increases taxable income if assets have appreciated, even if you haven't sold them. Conversely, it can create losses that offset other income, reducing overall taxable income. For day traders using mark-to-market, taxes are based on the year's realized gains and losses, leading to potentially higher or more predictable tax bills compared to standard trading methods.

What are the common mistakes in calculating taxable income?

Common mistakes in calculating taxable income from day trading include forgetting to subtract trading expenses, ignoring the wash sale rule, mixing personal and trading accounts, not accounting for capital losses or gains properly, and overlooking the need to report all trades accurately. Some traders also fail to differentiate between short-term and long-term gains, leading to incorrect tax rate application.

How can I reduce my taxable income from day trading?

To reduce taxable income from day trading, consider using tax-advantaged accounts like IRAs or 401(k)s, which shield gains from current taxes. Track all trading expenses—commissions, data fees, software—as they can be deducted. Hold trades longer to qualify for long-term capital gains rates, which are lower. Offset gains with losses through tax-loss harvesting—sell losing trades to reduce taxable income. Keep detailed records and consult a tax professional to identify specific deductions and strategies tailored to your trading activity.

Learn about How to Transition from Pattern Day Trader to Longer-Term Trading?

Conclusion about How to Calculate Taxable Income from Day Trading

In summary, understanding how to calculate taxable income from day trading is crucial for maximizing your profits and minimizing your tax liabilities. By accurately determining your gross profit, deducting eligible expenses, and comprehending the implications of short-term gains, you can effectively manage your obligations. Remember to keep thorough records and stay informed about tax strategies specific to day trading. For more personalized guidance on navigating these complexities, DayTradingBusiness is here to assist you in optimizing your trading experience.

Learn about How to Report Day Trading Income on Your Tax Return