Did you know that trading too much can turn you into a "Pattern Day Trader" faster than you can say "buy low, sell high"? Understanding the implications of the PDT rule is essential for traders looking to navigate the markets without facing severe penalties. This article breaks down the PDT rule, its purpose, and the consequences of violating it. You'll learn what happens if you breach the rule, how long violations linger on your record, and the potential financial and account restrictions you might face. Additionally, we’ll cover strategies to avoid violations, the enforcement of broker policies, and whether there's a legal way to bypass the PDT rule. With insights from DayTradingBusiness, you’ll be equipped with best practices to protect your trading activities.

What is the PDT rule?

Violating the PDT rule can lead to your brokerage account being restricted for 90 days, during which you can't make more than three day trades. If you exceed this limit, your account may be flagged as a pattern day trader account, requiring a minimum equity of $25,000 to continue day trading. Failure to meet this requirement can result in account suspension or restrictions on trading activities.

Why does the PDT rule exist?

The PDT rule exists to prevent excessive day trading and protect retail investors from risky, impulsive trades. It limits traders to four day trades within five days unless they have a margin account with over $25,000. Violating the PDT rule results in restrictions, like a 90-day trading suspension or account limitations, to curb reckless trading behaviors.

What happens if I violate the PDT rule?

If you violate the PDT rule, your brokerage will restrict your trading account for 90 days, preventing you from executing new trades until the restriction lifts. During this period, you can't day trade unless you deposit more funds or meet margin requirements. Repeated violations can lead to account suspension or closure.

How long do PDT violations stay on my record?

PDT violations stay on your record for 3 years.

What are the financial penalties for violating the PDT rule?

The PDT rule penalizes violating traders by restricting them from trading for 90 days if they execute four or more day trades within five business days without sufficient margin. The account is flagged as a pattern day trader, and you'll need to meet a minimum $25,000 equity requirement to resume trading.

Can I face account restrictions for PDT violations?

Yes, violating the PDT rule can lead to account restrictions, such as a 90-day trading suspension or restrictions on trading activities until the violation is cleared.

Are there legal consequences for breaking the PDT rule?

Yes, violating the PDT rule can lead to account restrictions, such as a 90-day trading suspension, and your broker may impose a pattern day trader margin call requiring you to deposit more funds.

How does a PDT violation impact my trading account?

A PDT violation locks your account with less than $25,000 in equity, preventing you from placing new trades until you meet the minimum requirement. Your account gets flagged, and you must deposit additional funds or wait 90 days for the restriction to lift if you repeatedly violate the rule.

What steps can I take to avoid PDT violations?

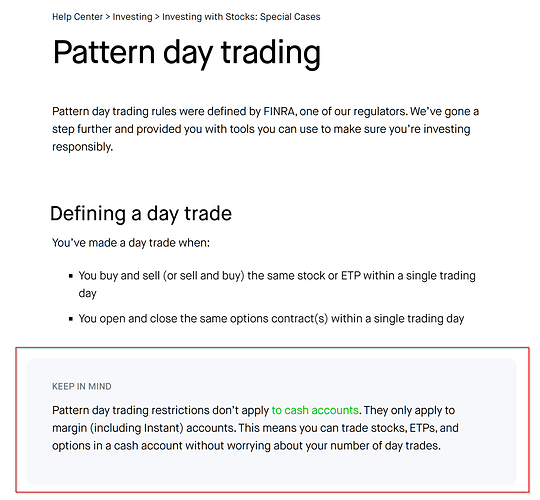

To avoid PDT violations, always trade with a margin account that has at least $25,000 in equity. Wait 90 days if your account drops below that threshold before trading again. Be cautious with day trading; limit your day trades to no more than three within five business days unless your account qualifies as pattern day trading. Maintain accurate records of your trades. Consider using cash accounts if you want to avoid PDT rules altogether.

Can I get a second chance after violating the PDT rule?

Yes, you can get a second chance after violating the PDT rule, but your account will face restrictions. The SEC typically imposes a 90-day trading suspension if you execute four or more day trades within five business days in a margin account. During this period, your trading is limited, and repeated violations can lead to longer restrictions or account restrictions.

How do broker policies enforce the PDT rule?

Broker policies enforce the PDT rule by restricting accounts with less than $25,000 from making more than three day trades within five business days. If you hit the limit, the broker automatically places a temporary restriction, often called a "pattern day trader" restriction, preventing further day trades until the account balance is restored or the rule is followed. They also monitor trading activity closely and flag accounts that violate the rule, leading to account freezes or penalties if the rule is broken repeatedly.

Learn about How Do Brokerage Firms Enforce the PDT Rule?

Is there a way to bypass the PDT rule legally?

No, there’s no legal way to bypass the PDT rule. Brokerage firms enforce it to prevent pattern day trading without proper account balance. Trying to bypass it risks account suspension or restrictions. The only legal way is to meet the minimum $25,000 equity requirement or avoid frequent day trades.

What is the difference between a violation and an error?

A violation of the PDT rule occurs when you execute more than three day-trades in a five-business-day period without sufficient margin, triggering restrictions on your account. An error, in this context, might be a mistake like miscalculating your trades or misunderstanding the rules, but it doesn’t automatically result in penalties unless it leads to a violation. The key difference is that violations involve breaking specific rules, while errors are mistakes that may or may not cause penalties if they don't breach regulations.

How do I monitor my trades to prevent PDT violations?

To monitor your trades and avoid PDT violations, track your 3-day trading count in your brokerage account. Use alerts or account summaries that notify you when you're nearing the 3-day limit. Consider switching to a cash account or reducing frequent day trades if you're close to the limit. Keep detailed records of your trades to identify patterns that could lead to violations. Regularly review your trading activity to stay within the PDT rule’s constraints.

Can automated trading reduce PDT violation risk?

Yes, automated trading can help reduce PDT violation risk by monitoring and managing trading activity to prevent excessive day trades. Automated systems can track your trades in real-time, alerting or stopping trades before violations occur. However, if the system isn’t properly set up, it won't eliminate the risk entirely.

What are the best practices for active traders regarding the PDT rule?

The PDT rule requires maintaining a $25,000 account balance to day trade more than three times in five business days. Violating it results in a 90-day trading restriction, freezing your ability to day trade until the account meets the minimum equity. To avoid penalties, active traders should monitor their trading frequency, keep account equity above $25,000, and consider using a cash account or a pattern day trader exemption if eligible.

Conclusion about What Are the Penalties for Violating the PDT Rule?

In summary, understanding the Pattern Day Trader (PDT) rule is crucial for any active trader. Violating this rule can lead to significant penalties, including account restrictions and financial consequences. To avoid these pitfalls, traders should monitor their trades closely, adhere to broker policies, and employ best practices for active trading. DayTradingBusiness offers valuable insights and resources to help you navigate these regulations and enhance your trading strategy effectively.

Sources:

- Measurement of nitrogen dioxide diffusive sampling rates for Palmes ...

- The Indonesian Legal Paradigm Concept about Tort Law (Analyse ...

- Is it possible for Curcumin to conjugate with a carbon nanotube in ...

- Up-regulation of Cyclooxygenase-2 and Apoptosis Resistance by ...

- Theory of atmospheric quantum channels based on the law of total ...

- The Sovereign Shield