Did you know that the average person spends about six months of their life waiting for red lights to turn green? In the world of day trading, compliance issues can feel just as frustrating, but they’re crucial for a smooth operation. This article dives into the most common compliance challenges faced by day trading brokers, including anti-money laundering laws, reporting requirements, and KYC violations. We’ll also explore how brokers manage customer suitability, handle account verification, and adhere to SEC and FINRA regulations. Additionally, we’ll discuss typical penalties for non-compliance and the importance of ongoing training for compliance staff. At DayTradingBusiness, we provide you with the essential insights to navigate these complexities and ensure a compliant trading environment.

What are the most common compliance issues for day trading brokers?

The most common compliance issues for day trading brokers include inadequate customer verification (KYC), failure to monitor suspicious trading activity, misrepresentation of risks, non-compliance with anti-money laundering (AML) regulations, and poor record-keeping. Brokers often face issues with improper disclosures about trading risks and insufficient supervision of trading practices to prevent market manipulation.

How do anti-money laundering laws affect day trading brokers?

Anti-money laundering laws require day trading brokers to verify customer identities, monitor transactions for suspicious activity, and report large or unusual trades. This adds extra compliance steps, increasing operational costs and complexity. Brokers must implement AML programs, train staff, and maintain records, which can slow down trading processes and create legal risks if neglected. Overall, AML laws tighten scrutiny on day trading brokers to prevent money laundering, forcing them to balance swift trading with rigorous oversight.

What are the reporting requirements for day trading brokers?

Day trading brokers must file suspicious activity reports (SARs) for any suspicious transactions, maintain detailed records of customer transactions and communications for at least five years, and report large cash transactions over $10,000 to FinCEN. They need to comply with Know Your Customer (KYC) rules, verify client identities, and monitor for money laundering or fraud. Additionally, brokers must adhere to SEC and FINRA regulations, including reporting large or unusual trading activity and ensuring proper recordkeeping of all customer accounts.

How do brokers ensure customer suitability and risk assessment?

Brokers evaluate customer suitability by analyzing trading experience, financial status, and investment goals through detailed questionnaires. They perform risk assessments by reviewing clients’ trading history, risk tolerance, and financial capacity to handle potential losses. Brokers also verify customer identities and conduct ongoing monitoring to ensure trading activity aligns with declared profiles, complying with regulations like AML and KYC.

What are the typical regulatory fines faced by day trading brokers?

Day trading brokers typically face regulatory fines ranging from hundreds of thousands to millions of dollars for violations like improper order handling, failing to disclose risks, or inadequate client protections. Common fines include penalties for misconduct such as unauthorized trading, misleading clients, or violating anti-money laundering rules. The exact amount depends on the severity of the breach and the regulatory body, like the SEC or FINRA.

How do brokers handle client account verification?

Brokers verify client accounts by collecting ID documents like driver's licenses or passports, proof of address such as utility bills, and sometimes financial statements. They run these through identity verification services to confirm identity and prevent fraud. Brokers also check against AML and KYC databases, and may perform video or live verification. This process helps ensure clients are legitimate and compliant with regulatory standards.

What are the common violations of know-your-customer (KYC) policies?

Common violations of KYC policies in day trading brokers include failing to verify customer identities, accepting accounts without proper documentation, not updating customer information regularly, allowing anonymous or fake accounts, and neglecting to monitor for suspicious activity.

How do brokers comply with SEC and FINRA regulations?

Brokers comply with SEC and FINRA regulations by implementing strict policies on client suitability, maintaining accurate records, performing regular audits, and enforcing anti-money laundering procedures. They ensure proper disclosure of risks, adhere to margin and leverage rules, and monitor trading activity for suspicious behavior. Training staff on compliance standards and submitting required reports on time also keep them aligned with regulatory demands.

What are the challenges in maintaining proper trade reporting?

Challenges in maintaining proper trade reporting include ensuring real-time accuracy, managing complex transaction data, adapting to changing regulations, preventing reporting errors, and handling large volumes of trades efficiently.

How do brokers manage conflicts of interest?

Brokers manage conflicts of interest by implementing strict policies that separate client interests from firm profits, such as firewalls between research and trading desks. They disclose potential conflicts transparently and avoid incentivizing trades that benefit the broker at the client's expense. Regular audits and compliance training ensure staff follow these rules, maintaining fair trading practices.

What are the penalties for failing to detect fraudulent activities?

Penalties for failing to detect fraudulent activities include hefty fines, license suspension or revocation, legal action, and reputational damage that can lead to client loss. Regulatory agencies like the SEC or FINRA may impose monetary sanctions and require increased oversight. In severe cases, individuals face criminal charges, jail time, or civil lawsuits.

How do brokers ensure data security and privacy compliance?

Brokers secure data by encrypting sensitive information, using secure servers, and implementing multi-factor authentication. They conduct regular security audits and monitor systems for breaches. To ensure privacy compliance, they follow regulations like GDPR and CCPA, restrict data access to authorized staff, and maintain detailed audit logs. They also train employees on data protection and update policies to align with evolving legal standards.

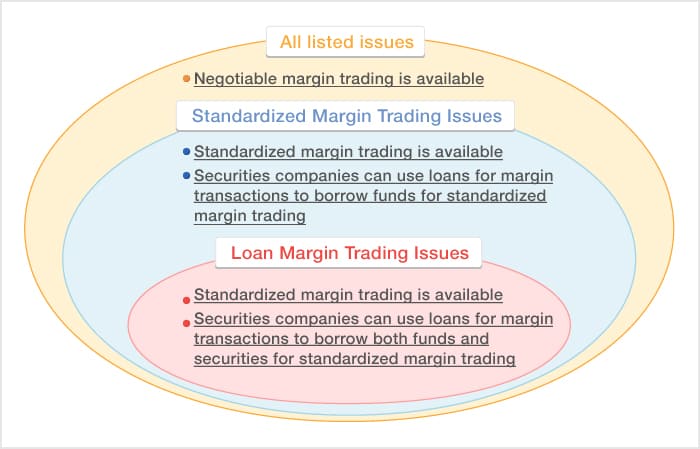

What are the key compliance issues in margin trading?

Key compliance issues in margin trading include proper client verification (KYC), ensuring clients meet margin requirements, preventing overleveraging, monitoring for suspicious or manipulative trading activities, timely margin calls, accurate reporting and record-keeping, and adherence to leverage limits set by regulators.

How do brokers handle solicitation and advertising laws?

Brokers handle solicitation and advertising laws by following strict regulatory guidelines that prohibit false claims, misleading statements, and unsubstantiated promises. They ensure all promotional content is transparent, accurately presents risks, and includes required disclosures. Many use compliance teams or legal advisors to review marketing materials before publication. They also adhere to platform-specific rules, avoid aggressive sales tactics, and maintain records of advertising efforts to demonstrate compliance if audited.

What are the ongoing training requirements for compliance staff?

Compliance staff must complete regular training on evolving regulations, including anti-money laundering (AML), know your customer (KYC), and cybersecurity protocols. They typically need annual or semi-annual updates to stay current with changing laws and industry standards. Ongoing training also covers new compliance software, risk management practices, and recent enforcement actions to ensure staff can identify and address emerging issues effectively.

Conclusion about Common Compliance Issues for Day Trading Brokers

In summary, day trading brokers face a myriad of compliance challenges, from anti-money laundering laws to customer suitability assessments. Understanding these issues is crucial for maintaining regulatory standards and protecting clients. For traders looking to navigate this complex landscape, DayTradingBusiness offers essential insights and guidance to ensure compliance and optimize trading strategies.

Learn about What Are the Responsibilities of Day Trading Brokers Under Compliance Laws?

Sources:

- FRB: Supervisory Letter SR 93-13 (FIS) on violations of Federal ...

- Appendix Comprehensive Review of Regulation W Overview of the ...

- Frequently Asked Questions - Federal Reserve Board

- Interagency Supervisory Guidance on Counterparty Credit Risk ...

- Frequently Asked Questions about ... - Federal Reserve Board

- SR 00-9 attachment: Guidance on Equity Investment and Merchant ...