Did you know that the SEC once tried to regulate the length of time traders could wear pants while trading? Just kidding—trading attire isn’t on their radar, but their rules certainly are! In this article, we dive into how SEC regulations shape day trading activities. Discover how these rules govern trading practices, including the Pattern Day Trader rule, minimum equity requirements, and leverage limitations. We also explore the implications of margin use, short selling, and excessive trading, along with reporting requirements and the penalties for violations. Whether you're a retail or institutional trader, understanding SEC regulations is crucial for compliance and success. Join us at DayTradingBusiness as we unravel the complex landscape of SEC rules and their impact on your trading strategies.

How do SEC rules regulate day trading?

SEC rules limit day trading by requiring a minimum account balance of $25,000 for pattern day traders. They also impose restrictions on leverage and margin use, making it harder to execute large, frequent trades without sufficient capital. The SEC enforces compliance through monitoring trading activity, and violations can lead to account restrictions or bans. These rules aim to prevent excessive risk-taking and protect retail investors from significant losses.

What are the key SEC restrictions for day traders?

SEC restrictions for day traders include a pattern day trader rule requiring a minimum of $25,000 account equity, limits on trading frequency to prevent excessive risk, and restrictions on using leverage beyond standard margin rules. These rules aim to prevent reckless trading and protect investors from significant losses.

How does the Pattern Day Trader rule affect trading?

The Pattern Day Trader rule requires traders with less than $25,000 in their account to limit their day trades to three within five days. If they exceed this, their account gets restricted for 90 days or until they meet the minimum equity. It forces traders to maintain higher account balances, reducing frequent trading and encouraging more cautious, long-term strategies.

What is the minimum equity requirement under SEC rules?

The SEC requires a minimum equity of $25,000 for pattern day trading activities.

How do SEC rules limit leverage for day traders?

SEC rules limit leverage for day traders by setting maximum margin requirements, often 25% for pattern day traders, meaning they must maintain at least 25% equity in their accounts. If their account falls below this, they face restrictions like a 90-day trading ban or margin calls. These rules prevent excessive borrowing, reducing potential losses and promoting responsible trading.

Are there specific SEC regulations on margin use in day trading?

Yes, SEC regulations limit margin use in day trading. Pattern day traders must maintain at least $25,000 in their margin account. If their account falls below this, they can't execute new day trades until they restore the minimum. The SEC enforces these rules to prevent excessive risk and protect investors.

How do SEC rules impact short selling in day trading?

SEC rules restrict short selling in day trading by implementing regulations like the uptick rule, which limits short sales to when the stock price is rising, reducing potential for market manipulation. They also require traders to comply with pattern day trader rules, meaning they need a minimum account balance of $25,000 to execute multiple short sales per day. These rules aim to prevent excessive short-selling risks and protect market stability during rapid trading.

What are the reporting requirements for day traders?

Day traders must track and report their trades accurately on IRS Schedule C or Schedule D, depending on their trading activity. They should keep detailed records of all transactions, including purchase and sale dates, prices, and commissions. If classified as a trader in securities, they may need to file Form 1099-B, but they’re responsible for reporting gains and losses correctly. The SEC doesn't impose specific reporting requirements for individual day traders but enforces regulations that affect trading practices, like pattern day trader rules, which require maintaining a minimum account balance. Proper recordkeeping ensures compliance with IRS tax reporting and helps avoid penalties.

How does the SEC address excessive trading practices?

The SEC limits excessive trading through rules like Pattern Day Trader (PDT) rules, requiring a minimum $25,000 account balance for frequent day trading. It enforces margin and leverage restrictions to prevent risky, manipulative practices. The SEC also monitors for market manipulation and imposes penalties on illegal trading schemes. These rules aim to curb reckless day trading and protect market integrity.

What penalties does the SEC impose for rule violations?

The SEC can impose fines, bans from trading, disgorgement of profits, and civil or criminal charges for rule violations, which can severely restrict or halt day trading activities.

How do SEC rules influence trading account types?

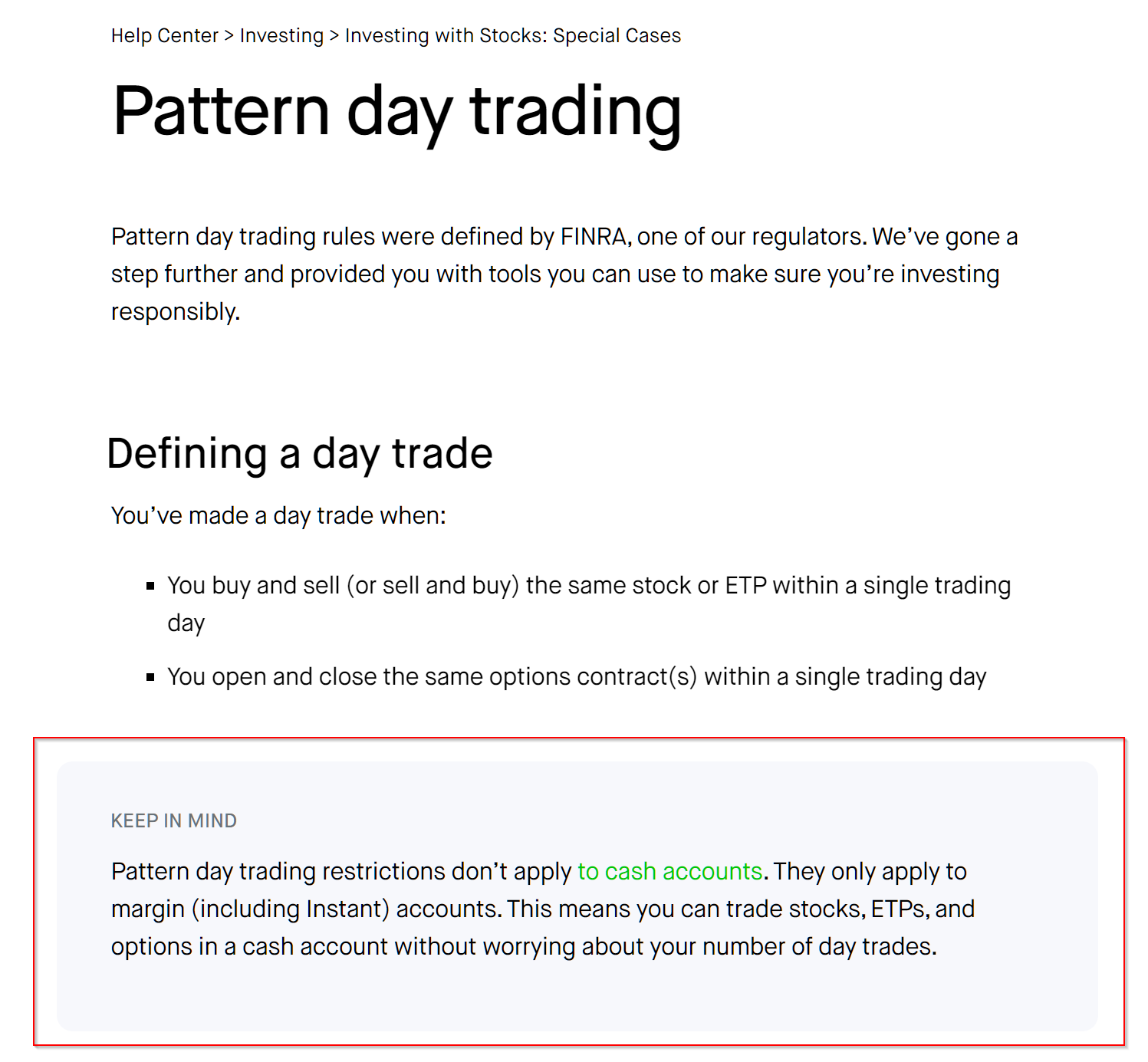

SEC rules set margin requirements and pattern day trading rules, limiting how much you can trade on borrowed funds and requiring a minimum account balance of $25,000 for day trading. They classify accounts as cash or margin, affecting the ability to execute rapid trades and leverage positions. These regulations prevent excessive risk-taking in day trading accounts and enforce disclosure and compliance standards that influence account types and trading strategies.

Learn about How Do SEC and FINRA Regulations Influence Day Trading Strategies?

Do SEC regulations differ for retail vs. institutional day traders?

Yes, SEC regulations differ for retail and institutional day traders. Retail traders face specific rules like the Pattern Day Trader (PDT) rule, requiring a minimum of $25,000 in account equity for frequent trading. Institutional traders are usually exempt from PDT and have different compliance standards, often dictated by their firm's policies and larger capital requirements. These differences affect leverage, reporting, and permissible trading frequency.

Learn about What Are SEC and FINRA Regulations for Day Traders?

How can traders ensure compliance with SEC regulations?

Traders ensure compliance with SEC regulations by staying updated on rules like Pattern Day Trader (PDT) rules, maintaining proper account documentation, avoiding market manipulation, and adhering to trading limits. Using approved trading platforms, following disclosure requirements, and consulting with legal or compliance experts also help ensure they meet SEC standards.

Learn about How to Ensure Compliance with SEC & FINRA Regulations

What changes have recent SEC rules brought to day trading?

Recent SEC rules limit the use of leverage and impose stricter margin requirements for day traders, especially those classified as pattern day traders. They require a minimum of $25,000 in account equity to engage in frequent day trading activities. These rules also enforce stricter reporting and monitoring to prevent excessive risk-taking. As a result, day traders face higher capital thresholds and reduced ability to use borrowed funds, making aggressive trading more difficult.

Learn about How Do SEC Rules Impact Day Trading?

How do SEC rules impact trading hours and market access?

SEC rules limit margin requirements and impose pattern day trader rules, affecting how often and how much you can trade. They require a minimum account balance of $25,000 for frequent day trading, restricting access for smaller accounts. These regulations also enforce trade reporting and transparency, which can slow down rapid trading activities. Overall, SEC rules can restrict trading hours by imposing rules that discourage excessive or risky day trading, shaping when and how traders can participate.

Learn about How Do SEC Rules Impact Day Trading?

Conclusion about How do SEC rules impact day trading activities?

Understanding the SEC's regulations is crucial for day traders to navigate the complexities of the market effectively. The rules establish clear guidelines on trading practices, leverage, margin use, and reporting requirements, which directly influence trading strategies and account types. By adhering to these regulations, traders can avoid penalties and make informed decisions. Staying updated with changes in SEC rules can enhance compliance and optimize trading activities. For more insights and guidance on adapting to these regulations, DayTradingBusiness is here to help.

Learn about How Do SEC Rules Impact Day Trading?