Did you know that some day traders have a better chance of finding a unicorn than consistently beating the market? While the odds may not be in their favor, understanding how brokers ensure compliance in day trading can significantly enhance your trading experience. This article delves into the crucial mechanisms brokers use to monitor trading activities, adhere to regulations, and detect illegal practices. You'll learn about KYC procedures, trade reporting accuracy, and the tools brokers implement to enforce compliance. We’ll also explore the common risks involved, how brokers manage margin and leverage, and the penalties for non-compliance. Lastly, find out how regulatory bodies oversee broker actions and the vital role of compliance departments within broker firms. With insights from DayTradingBusiness, you can navigate the trading landscape with confidence.

How Do Brokers Monitor Day Trading Activities?

Brokers monitor day trading activities through real-time transaction analysis, flagging patterns like excessive trading volume or pattern day trading violations. They use automated systems to detect suspicious or risky behaviors, such as rapid buy-sell cycles or margin misuse. Brokers also review trading logs and account activity for compliance with regulatory rules and margin requirements. They may flag accounts for review if trading activity exceeds set thresholds or shows signs of potential market manipulation. Regular audits and automated alerts help brokers ensure traders follow rules and prevent illegal or risky practices.

What Regulations Do Brokers Follow for Compliance?

Brokers follow regulations like the SEC rules, FINRA standards, and SIPC protections. They implement AML and KYC procedures, maintain transparent trade reporting, and ensure proper client fund segregation. Regular audits, compliance training, and trading restrictions for certain securities also keep brokers within legal boundaries.

How Do Brokers Detect Illegal Trading Practices?

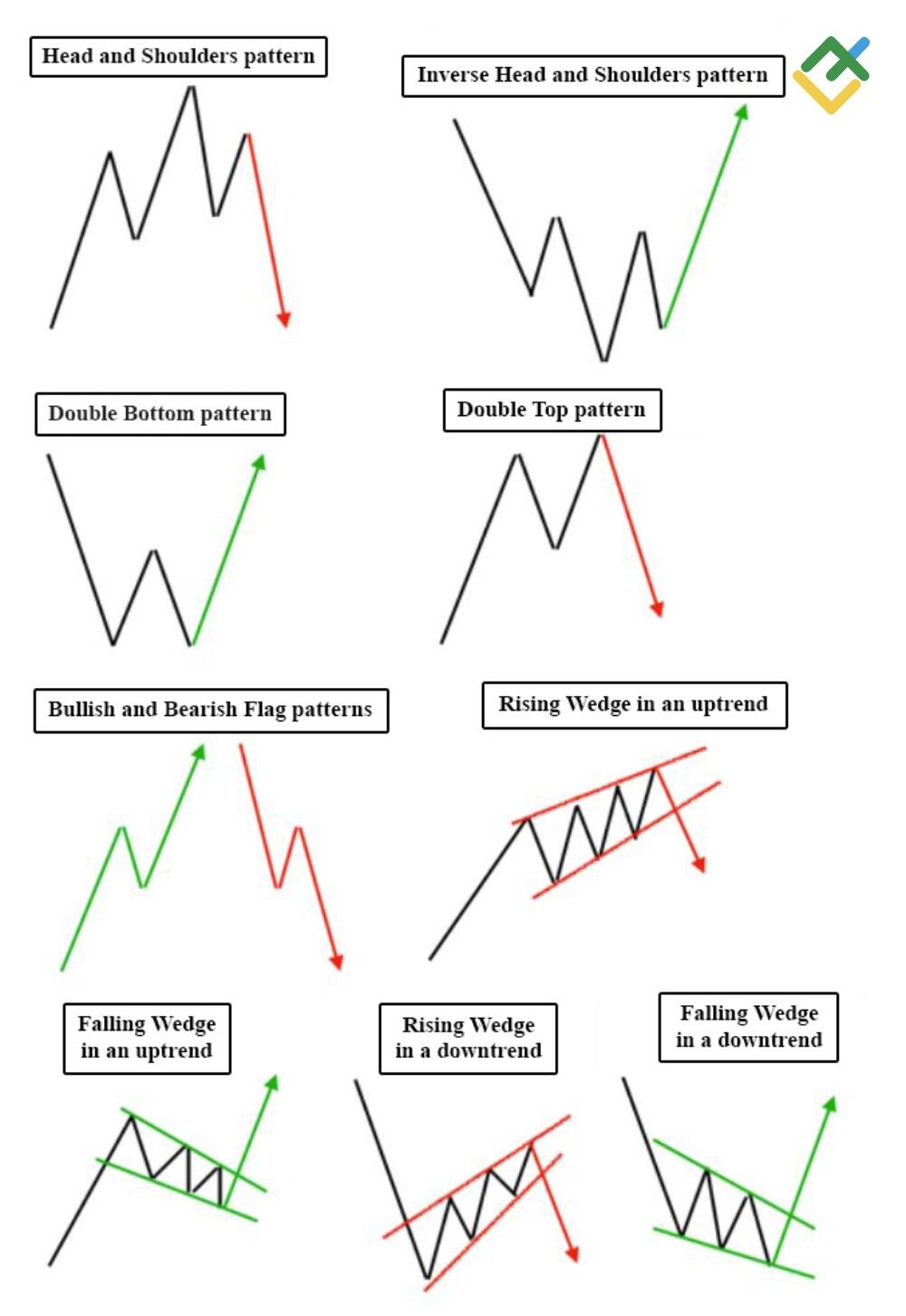

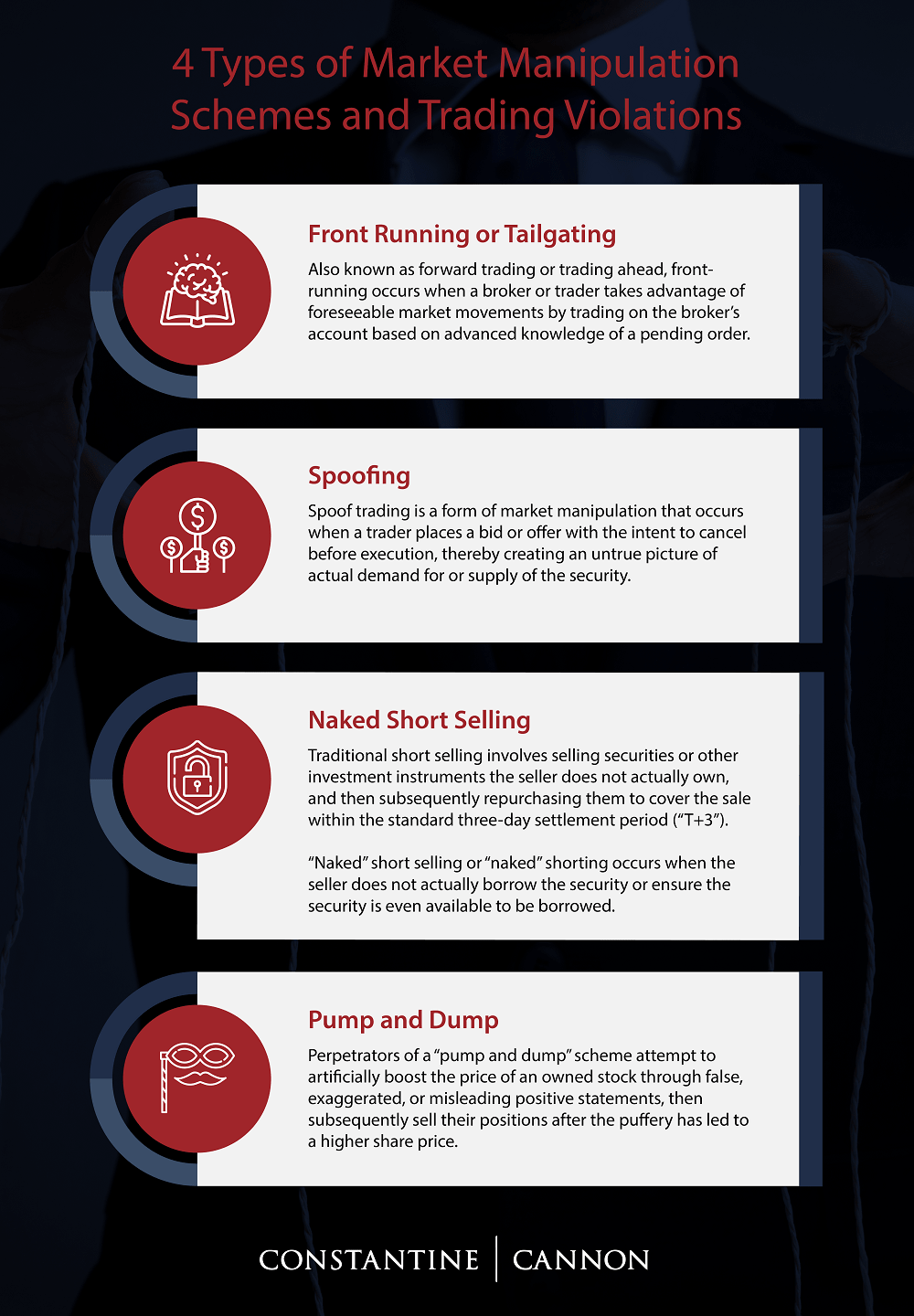

Brokers detect illegal trading by monitoring for suspicious patterns like pump-and-dump schemes, insider trading signals, and abnormal order activity. They use advanced algorithms and real-time analytics to flag irregular trades that deviate from typical market behavior. Compliance teams review flagged transactions, compare them against regulatory rules, and investigate anomalies. They also track large, rapid trades and unusual volume spikes that suggest manipulative practices. Automated systems scan for insider information leaks or coordinated trading among accounts. When suspicious activity is identified, brokers report it to regulators or halt trading to prevent illegal practices.

What Are the KYC Procedures for Day Traders?

Brokers verify your identity by collecting government-issued ID, proof of address, and sometimes a selfie. They check your financial background, trading experience, and ensure you meet minimum capital requirements. You may need to fill out a risk assessment or suitability questionnaire. These KYC procedures are designed to prevent fraud, money laundering, and ensure you understand the risks of day trading.

How Do Brokers Ensure Trade Reporting Accuracy?

Brokers ensure trade reporting accuracy by using automated systems that log every trade instantly, cross-verify data with exchange feeds, and conduct regular audits. They implement strict internal controls, employ compliance teams to monitor discrepancies, and use real-time alerts for suspicious activity. Training staff on regulations and maintaining detailed records also help prevent errors, ensuring trades are reported correctly and in compliance.

What Tools Do Brokers Use to Enforce Compliance?

Brokers use compliance monitoring software, trade surveillance tools, and real-time audit systems to enforce rules. They rely on automated alerts for suspicious activity, KYC verification platforms, and transaction monitoring solutions. Regulatory reporting tools help ensure adherence to legal standards. Internal policies backed by compliance officers also enforce trading rules directly.

How Do Brokers Manage Margin and Leverage Limits?

Brokers manage margin and leverage limits by setting strict maximum ratios and monitoring traders' positions in real-time. They automatically enforce margin calls when account equity drops below required levels, preventing traders from exceeding leverage caps. Brokers use risk management systems to flag or restrict high-leverage trades, ensuring compliance with regulations and internal policies. They also conduct regular account reviews and restrict trading activity if limits are approached or breached.

What Are the Common Compliance Risks in Day Trading?

Brokers ensure compliance in day trading by monitoring trades for pattern violations, enforcing leverage limits, and verifying client identities to prevent money laundering. They also track suspicious activities, report large or unusual transactions to authorities, and ensure traders follow regulations like pattern day trading rules. Regular audits and real-time oversight help prevent violations of securities laws and trading standards.

How Do Brokers Handle Suspicious Trading Behavior?

Brokers monitor trading activity in real-time for unusual patterns like sudden volume spikes or abnormal price moves. They flag suspicious trades and may temporarily suspend accounts for review. Brokers use automated algorithms and manual oversight to detect potential market manipulation or insider trading. If suspicious activity is confirmed, they report it to regulators and may restrict or close the trader’s account to maintain compliance.

What Record-Keeping Requirements Do Brokers Follow?

Brokers maintain detailed trade logs, monitor client activity for suspicious patterns, and retain records of transactions, account statements, and communications for at least five years. They implement robust compliance systems, conduct regular audits, and ensure clients adhere to regulatory reporting standards such as pattern day trading rules.

How Do Brokers Educate Traders About Rules?

Brokers educate traders about rules through webinars, online tutorials, and detailed trading policies. They provide onboarding sessions explaining regulatory requirements and proper trading practices. Many offer real-time alerts and updates on rule changes to keep traders compliant. Brokers also use educational materials like videos and articles to clarify regulations and trading limits. Regular communication, quizzes, and compliance tests ensure traders understand and follow the rules.

What Are the Penalties for Non-Compliance?

Penalties for non-compliance include fines, trading bans, account suspensions, and potential legal action. The SEC and FINRA enforce these rules, and violations can lead to hefty financial penalties or disqualification from trading. Brokers face regulatory sanctions, reputational damage, and loss of licenses if they fail to ensure clients follow trading regulations.

How Do Regulatory Bodies Oversee Broker Compliance?

Regulatory bodies oversee broker compliance by setting rules for transparency, fair trading, and capital requirements. They conduct audits, review transaction data, and monitor trading activity for suspicious behavior. Brokers must adhere to reporting standards, maintain proper records, and implement internal controls. Regular inspections and penalties enforce compliance, ensuring brokers follow laws designed to protect investors and maintain market integrity.

How Do Brokers Prevent Market Manipulation?

Brokers prevent market manipulation by monitoring trades for suspicious activity, enforcing strict compliance policies, and using advanced algorithms to detect manipulative patterns. They restrict large or rapid trades that could influence prices, require transparent reporting, and conduct regular audits. Additionally, brokers educate traders on legal boundaries and enforce penalties for violations to maintain fair market conditions.

What Is the Role of Compliance Departments in Broker Firms?

Compliance departments in broker firms enforce regulations, monitor trading activities, and ensure adherence to legal standards. They develop policies, conduct audits, and train traders on rules to prevent violations. In day trading, they review transactions for suspicious or illegal activity, ensure proper reporting, and maintain transparency. Their role is to protect the firm from legal risks and uphold market integrity.

Conclusion about How Do Brokers Ensure Compliance in Day Trading?

In summary, brokers play a crucial role in ensuring compliance within the day trading landscape through rigorous monitoring, adherence to regulations, and implementation of robust procedures. By actively detecting illegal practices, managing margin limits, and maintaining accurate trade reporting, they safeguard the integrity of the market. Additionally, compliance departments educate traders about regulations and enforce penalties for non-compliance. For traders seeking insights and support in navigating these complexities, DayTradingBusiness offers valuable resources to enhance understanding and adherence to trading standards.

Learn about What should beginners know about legal compliance in day trading?