Did you know that traders sometimes risk more on a single trade than they would on a night out in Vegas? In the world of day trading, poor risk management can be the silent killer of your trading account. This article dives deep into the crucial aspects of risk management, highlighting how it directly impacts profits and the red flags of risky trading behaviors. We’ll explore the dangers of excessive leverage, the necessity of stop-loss orders, and the pitfalls of overtrading. Additionally, we’ll cover the importance of a solid trading plan, the consequences of ignoring market volatility, and the critical role of emotional decision-making. By understanding these key elements, you can significantly enhance your trading strategies. Join us as we unravel how to safeguard your investments with effective risk management practices, brought to you by DayTradingBusiness.

How does poor risk management impact day trading profits?

Poor risk management can wipe out your day trading profits quickly. It exposes you to large losses from small mistakes or unexpected market moves. Without proper stop-losses or position sizing, a few bad trades can deplete your account. Even a single big loss can wipe out weeks of gains, making recovery impossible. It also increases emotional stress, leading to impulsive decisions that compound losses. In short, neglecting risk management turns potential profits into rapid account erosion.

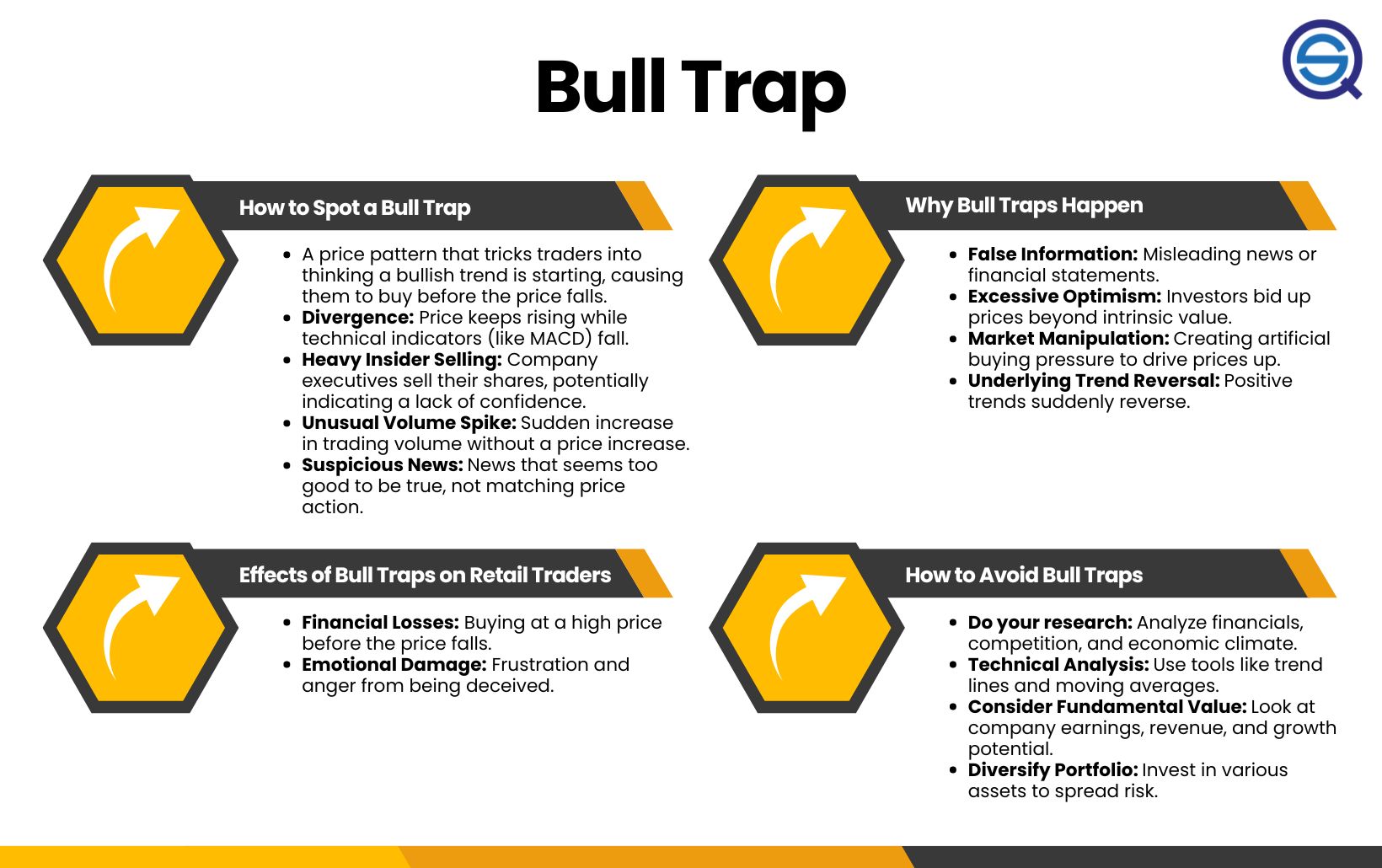

What are the common signs of risky trading behaviors?

Common signs of risky trading behaviors include overtrading, risking more than 1-2% of your account on a single trade, ignoring stop-loss orders, chasing losses, revenge trading after losses, and holding onto losing positions in hopes of a turnaround. These habits often lead to rapid account depletion, emotional decision-making, and big swings in account balance, risking overall ruin.

How can excessive leverage increase the risk of account ruin?

Excessive leverage amplifies both gains and losses, so a small market move against you can wipe out your account quickly. When you overuse leverage, even a minor mistake or sudden market shift can lead to margin calls or forced liquidations. Poor risk management with high leverage leaves little room for error, making your account vulnerable to rapid ruin.

Why is setting stop-loss orders crucial in day trading?

Setting stop-loss orders is crucial in day trading because it limits potential losses when the market moves against you. Without stop-losses, a small mistake can quickly wipe out your account. Poor risk management, like not using stops, exposes your capital to large, uncontrollable losses that can ruin your day trading account. It helps you stick to a plan, protect your funds, and avoid emotional decisions during volatile trades.

How does overtrading lead to account depletion?

Overtrading drains a trading account by increasing transaction costs and risking larger sums without proper analysis. It leads to frequent, impulsive trades that often result in losses. Poor risk management amplifies this by ignoring stop-losses and position sizes, causing quick account depletion. The more trades made without strategy, the faster the capital erodes, especially during losing streaks.

What role does emotional trading play in risking the account?

Emotional trading causes impulsive decisions, leading to overtrading or holding losing positions longer. It clouds judgment, making it hard to stick to risk limits. This increases the chance of large losses, risking the entire account. Emotional reactions can override rational risk management, turning small losses into devastating ones.

How can ignoring market volatility harm your trading account?

Ignoring market volatility can cause sudden, large losses that wipe out your trading account. Without proper risk management, you might overexpose yourself during volatile swings, leading to rapid drawdowns. It increases the chance of making impulsive decisions based on unexpected price swings. Over time, unmanaged volatility can deplete your capital, making it hard to recover from losses. Proper risk controls prevent small setbacks from turning into account-breaking blows.

What are the risks of poor position sizing?

Poor position sizing increases the risk of large losses that can wipe out your trading account quickly. It leads to overexposure, making small market swings devastating. This can cause mental stress, impulsive decisions, and a loss of confidence. Over time, it hampers capital growth and can force you to stop trading or blow up your account entirely.

How does lack of a trading plan increase account risk?

Without a trading plan, traders make impulsive decisions, risking more on guesses rather than strategies. This leads to larger, unmanaged losses if the market moves against them. Without clear entry and exit rules, they can hold onto losing trades too long or take unnecessary risks, quickly draining their account. Poor risk management, like not setting stop-losses, amplifies the damage, making a single bad trade wipe out a significant portion of their capital.

Why is inconsistent risk management a recipe for failure?

Inconsistent risk management leads to unpredictable losses, wiping out gains and damaging confidence. Without a solid plan, a single bad trade can escalate into a big loss, draining your account quickly. Poor risk control causes emotional trading, leading to impulsive decisions that compound mistakes. Over time, this chaos erodes capital, making it impossible to recover. Consistent risk management is the foundation that keeps a day trading account stable and helps avoid catastrophic failures.

How can failure to diversify trades threaten your account?

Failing to diversify trades increases risk exposure, making your account vulnerable to a single bad move or market turn. If one trade hits, it can wipe out a significant portion of your capital, leaving little room for recovery. Without diversification, losses compound quickly, risking your account’s survival. Poor risk management means you might overcommit to risky trades, amplifying the damage from market swings. This can lead to rapid account depletion and eliminate your chances for steady growth.

What are the consequences of ignoring risk-reward ratios?

Ignoring risk-reward ratios can lead to excessive losses on small wins, draining your trading capital quickly. Without proper risk management, a single bad trade can wipe out a significant portion of your account. This mindset causes reckless trading, increasing the chance of emotional decisions and larger, unnecessary losses. Over time, neglecting risk-reward ratios ruins your ability to grow your account steadily and can lead to complete account blowouts.

How does trading without proper analysis increase loss potential?

Trading without proper analysis leads to poor entry and exit points, increasing the chance of losing trades. Without analyzing market trends and data, you can’t identify high-probability setups or avoid risky moves. This lack of insight causes impulsive decisions, exposing your account to bigger, unnecessary losses. Poor analysis also means missing warning signs, making it easier to hold onto losing positions longer than you should. Overall, skipping thorough research amplifies risk, making your account more vulnerable to significant, avoidable losses.

Can poor risk management lead to margin calls?

Yes, poor risk management can lead to margin calls by exposing your account to excessive losses. If you don’t set proper stop-loss orders or limit your position sizes, sudden market swings can wipe out your equity, triggering margin calls from your broker. This forces you to add more funds or close positions at a loss, potentially ruining your trading account.

Learn about How can poor risk management lead to losses in day trading?

How does emotional decision-making amplify trading risks?

Emotional decision-making leads traders to deviate from their strategies, causing impulsive trades and overexposure. It makes it harder to stick to stop-losses and risk limits, increasing the chance of large losses. When fear or greed take over, traders often chase losses or hold onto losing positions, amplifying risk. This emotional bias erodes discipline, making it easier to make reckless choices that can wipe out a trading account.

Learn about How Can Emotional Control Reduce Trading Risks?

What steps can traders take to improve risk management?

Traders can improve risk management by setting strict stop-loss orders, limiting position sizes, diversifying trades, and sticking to a predetermined risk-reward ratio. Regularly reviewing and adjusting trading plans, avoiding emotional decisions, and maintaining discipline also protect against large losses. Using risk management tools like trailing stops and managing leverage carefully helps prevent ruin.

Conclusion about How can poor risk management ruin a day trading account?

In summary, poor risk management can significantly jeopardize a day trading account, leading to diminished profits and increased losses. Recognizing risky behaviors, such as excessive leverage and emotional trading, is essential for maintaining account health. Implementing strategies like setting stop-loss orders, adhering to a trading plan, and understanding market volatility can mitigate risks. By prioritizing sound risk management practices, traders can safeguard their investments and enhance their chances of success. For more in-depth guidance on effective trading strategies, explore resources from DayTradingBusiness.

Learn about How to Develop a Risk Management Plan for Day Trading